In an exclusive interview with Inman, the CEO discussed Douglas Elliman’s recent initiatives and criticized the Compass-Anywhere merger as bad for agents and the real estate industry.

Inman Connect

Invest in yourself, grow your business—real estate’s biggest moment is in New York!

Invest in yourself, grow your business—real estate’s biggest moment is in New York!

Michael Liebowitz came in as CEO of Douglas Elliman in the fall of 2024, when the firm was in need of serious change.

The brokerage had seen a stretch of quarterly financial losses, former CEO Howard Lorber’s intimate relationships with two brokers were under scrutiny, and onlookers had called into question how the bad behavior of former top agents Tal and Oren Alexander (whose federal trial for sex trafficking begins this week) seemingly went unnoticed.

TAKE THE INMAN INTEL INDEX SURVEY

Liebowitz had a tall task ahead of him but went straight to work tightening up the firm’s finances, expanding ancillary services and leaning into Douglas Elliman’s luxury identity by launching its international division, Elliman International, and creating a national Estate, Trust & Probate division.

Next week, the CEO will speak at Inman Connect New York on a panel of other real estate leaders about how the next year will play out for the industry.

In advance of that event, Inman caught up with Liebowitz to get his latest thoughts on topics such as the Compass-Anywhere merger and what’s next for Douglas Elliman. Here’s what he had to say, edited for length and clarity.

Inman: I found it funny that last year, there were rumors floating around that Douglas Elliman was maybe going to be acquired by Anywhere. And then Anywhere ended up doing this big deal with Compass.

Liebowitz: I think it was the other way around, right? I don’t think Anywhere did it — I think Compass did it.

Ha, you may have a point. Well, what are your thoughts on that deal now that it’s closed? Were you surprised how quickly it closed, or even that it closed at all?

Listen, I’m definitely very surprised at how quickly it got done. I think the government shutdown, from what I’ve heard, really helped. Because no one was around for it, and it kind of got through.

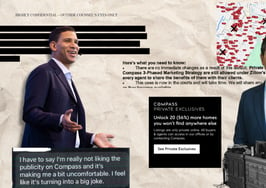

I do think there are big antitrust issues with it. I think they’re talking about private listings and trying to own the market, and that’s not good for consumers. An independent, strong competitor to them is going to be very important because I think they’re going to be doing things … they’re fighting with Zillow. Meanwhile, they’re talking about private listings and holding them only for themselves. First of all, I don’t know how you can have a private listing that’s open to 350,000 agents. I don’t know what’s private about that.

So I think the industry needs to be very careful because if they’re going to basically recruit all these other brokers, I mean, how big are they going to get? And I don’t think that’s very good for agents. I don’t think that’s very good for consumers at all.

And there’s not many alternatives, right? I mean, talk about brand dilution. I don’t know what brand to think of when I think of them. From the outside, it looks like a mess.

Interesting. I’ve been hearing some people in the industry say that maybe this will set off a lot more big M&A deals in the industry. Do you think that’s going to happen?

How many deals could you have? If you really think about it, you’ve got Century 21, Sotheby’s, ERA, Better Homes and Gardens, Compass, Corcoran. I mean, who’s left? There’s basically us, right? In the model that Anywhere and Compass was, except on the franchise side, which we’re not a franchise. EXp is not really the same model as them; REMAX is a total franchise business. I don’t know who’s left.

That’s why I say if you’re in Compass, Sotheby’s, Corcoran — again, I can go through that freaking list, it’s so long — and want a high-touch, individualized firm that’s in luxury, and that’s still big, we’re the alternative.

I mean, there’s really no other — I think we’re the only brokerage with no debt, right? So I think we’re unique. They’re all leveraged up, trying to do whatever they’re trying to do, and we’re a luxury player with one brand. No debt, independent.

People talk about consolidation — I just don’t know who’s going to consolidate with whom, that are natural combinations.

So how does that deal change Douglas Elliman’s strategy in upcoming years, if at all?

It’s a huge opportunity for us because of a lot of the things I just mentioned. If you are a luxury agent at Compass or Corcoran or Sotheby’s, and you don’t want to be in the mall — it’s a mall now, right, that company — and you want high touch, a lot of involvement with the agents….

We’re 6,500 agents. It’s a significant difference from 350,000.

We think we provide a very high-touch experience for agents, where you can actually speak to the CEO. You can speak to the leaders at the highest level of the company.

Reffkin will tell you how he’s going to cater to Coldwell Banker and Compass and Corcoran … You can’t do it. You can’t be all things to all people, even though they’re claiming they are.

As you just mentioned, you have no debt at this point and have tightened up your finances in the last couple of years, while also launching a bunch of new initiatives, like your own international division and a mortgage arm.

We’re going to be doing more in title; we’re going to be doing more in insurance. When I first came in, I really wanted to diversify the revenue stream right away. But you can’t do everything all at the same time. So we did a lot. Our transition year was ’25, our growth year is ’26.

So we’re fully transitioned. We’re now ready to grow. We launched Elliman Capital. We’re doing more title, more ancillary services. We’re hiring someone to lead that business, pure ancillaries, which we’ve never done before. We have a recruiting team that we’ve never had before.

We never had a recruiting or onboarding team for new agents. Agents just kind of came to us, and we hired them, and that was it. [But] Compass, which had a recruiting machine, all they did was recruit agents. They took every agent they could get, and that was it.

Even the recruiting that we’re going to do, we want to get to 10,000 or so agents, and that’s our goal. We’re not looking to be 30,000 agents or 40,000 agents because we just think that the agent experience is not the same in a company that big.

So is agent growth the next big thing you’re focused on?

Yeah, agent growth is a big thing to us, but, you know, also, our technology and our PR and our marketing and our international business. We’re working really hard. We’ve hired a lot of people at the upper levels of the company.

And, you know, we’re doing a lot, and we’re going to keep growing. Staying in luxury. We only want to be in the luxury market; markets that we go to are going to be luxury places. You’re not going to see us in a small town somewhere. It’s just not the direction we’re going.

I wanted to talk a bit more big picture for the industry. What do you think the industry needs to improve on the most in 2026?

I hate to make a lot about the Anywhere-Compass thing, but when you have two companies like that merge, it’s like Coke and Pepsi. That’s how big those two companies are that merged. So I think from an industry perspective, we’re focused on quality, they’re focused on quantity. You don’t do a deal like that unless that[‘s the point], or you see an issue in your current business model.

Anywhere was saddled with a lot of debt, so I think they had to do a deal, ultimately. I don’t think they were ever getting out from under it. Compass has been running a million miles an hour in a lot of different directions, just trying to hire as many agents as they can, and I guess merging with Anywhere made that kind of easy. And they did an all-stock deal so nobody had to come up with any money. They just put their stocks together.

So I think you’re going to see a lot more quality with the other firms that are in the industry. Again, a much higher-end experience, a much higher-touch experience. I think that’s going to change the industry a lot.

Talking now about the individual agent, what do you think that they need to focus on most in 2026?

I think the typical fundamentals. We all try and recreate the wheel and think there’s a magic bullet, but at the end of the day, it’s all about working very hard, meeting a lot of people, getting out there and networking, honing your craft, getting more knowledge about the market, the directions, the trends, what people want, where they want to be, negotiating skills — and that’s what an agent should work on.

Thinking more about Inman Connect New York next week, is there any message or words of wisdom you’d like to share with attendees?

You have to kind of give your life. For me, as the CEO of a company, our agents work seven days a week, so I do the same thing, because I’m speaking to them all the time.

So, dedicating yourself truly to your business, hiring the right people if you’re in a team, or even if you’re not in a team, whether it be an assistant, someone helping you, make sure you hire all of the right people that think the way you do and have the same work ethic that you do and really become an expert at the business. That’s the key.

It’s becoming that expert, becoming known as a thought leader, when somebody sits back and they think of who that person is, it’s like, oh yeah, they really know the business.

And it doesn’t matter which firm you’re with — that’s the key. Ultimately, when you pick a firm, you want to pick a firm that you’re going to get the attention, they’re the most aligned with you, and the management team is focused on you, your business, and building that business, and not some grander business plan.

Get Inman’s Luxury Lens Newsletter delivered right to your inbox. A weekly deep dive into the biggest news in the world of high-end real estate delivered every Friday. Click here to subscribe.

Email Lillian Dickerson

Topics: Anywhere | Compass | Douglas Elliman Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next 30 years of disruption: How Inman Connect became the front row seat to a changing industry

30 years of disruption: How Inman Connect became the front row seat to a changing industry

Douglas Elliman brings on industry marketing leader for rebrand

Douglas Elliman brings on industry marketing leader for rebrand

How this luxury pro became 1 of Elliman's top agents every year

How this luxury pro became 1 of Elliman's top agents every year

The world is an uncertain place. Mauricio Umansky is focused on growth and survival

More in Exclusive

The world is an uncertain place. Mauricio Umansky is focused on growth and survival

More in Exclusive

Buyers are returning, sellers are 'increasingly realistic about pricing': Pam Liebman

Buyers are returning, sellers are 'increasingly realistic about pricing': Pam Liebman

Redfin's Kelman on listing access: 'You shouldn't have to know the secret handshake'

Redfin's Kelman on listing access: 'You shouldn't have to know the secret handshake'

Washington to consider requiring all listings to be marketed publicly

Washington to consider requiring all listings to be marketed publicly

Docs offer inside peek at Compass’ war against ‘organized real estate’

Docs offer inside peek at Compass’ war against ‘organized real estate’

Read next

Read Next

30 years of disruption: How Inman Connect became the front row seat to a changing industry

30 years of disruption: How Inman Connect became the front row seat to a changing industry

Douglas Elliman brings on industry marketing leader for rebrand

Douglas Elliman brings on industry marketing leader for rebrand

Washington to consider requiring all listings to be marketed publicly

Washington to consider requiring all listings to be marketed publicly

AI is gaining converts in real estate marketing, but not everyone is a true believer (yet)

AI is gaining converts in real estate marketing, but not everyone is a true believer (yet)