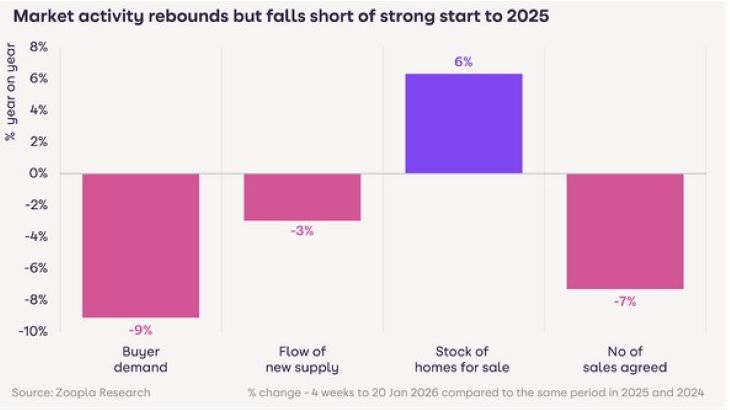

Data from both Zoopla and EXP highlights a less buoyant market than 2025, but a bounce back in the market is still clearly evident.

29th Jan 20261 710 1 minute read David Callaghan

Recovery in the property market is now well underway, new indicators from two different sources confirm.

Zoopla’s latest HPI shows that housing supply is up 6% on last year, and mortgage rates are touching the lowest point since 2022.

New instructionsAnd data from EXP reveals that in the first two weeks of the year new instructions were up 11% on two years ago.

Some figures show the market is less buoyant than a year ago when there was a surge ahead of the end of Stamp Duty holidays in April.

Buyer demand, for example, is 9% down on early 2025, Zoopla says, but the market is still looking healthy.

Wide variations

Wide variations

Regional and city house price inflation sees ranges from -2.6% to +5.5%, highlighting wide variations in market conditions, Zoopla highlights.

House prices increased by 1.2% during 2025 (1.9% in 2024), rising by £3,200 to £269,800.

After a weak end to 2025, home buyer confidence is returning.”

Richard Donnell, Executive Director at Zoopla, says: “After a weak end to 2025, home buyer confidence is returning as mortgage rates ease and those who delayed decisions last year return to the market.”

And Adam Day, Head of EXP UK and Europe, says: “We’re already seeing early signs of a strong start to the year for the housing market, and this aligns with what many agents were already reporting on the ground in the immediate wake of last November’s Autumn Budget and the removal of widespread market uncertainty.”

Industry reactionNathan Emerson, CEO at Propertymark, says: “Buyer confidence is slowly returning as mortgage rates ease, but this is a very different market compared to the one seen a year ago.

“Increased choice means buyers are taking more time, negotiating harder, and are far more price-sensitive, particularly in higher-value areas.”

More on the property market

TagsZoopla 29th Jan 20261 710 1 minute read David Callaghan Share Facebook X LinkedIn Share via Email