It has been a rough few years amid a steep transaction downturn. But real estate agents surveyed by Inman Intel are increasingly reporting genuine interest from homebuyers and sellers throughout their client pipelines ahead of a pivotal spring season.

Inman Connect

Invest in yourself, grow your business—real estate’s biggest moment is in New York!

Invest in yourself, grow your business—real estate’s biggest moment is in New York!

A growing number of real estate agents now believe a faster market turnaround is finally around the corner. And some report it may already be underway.

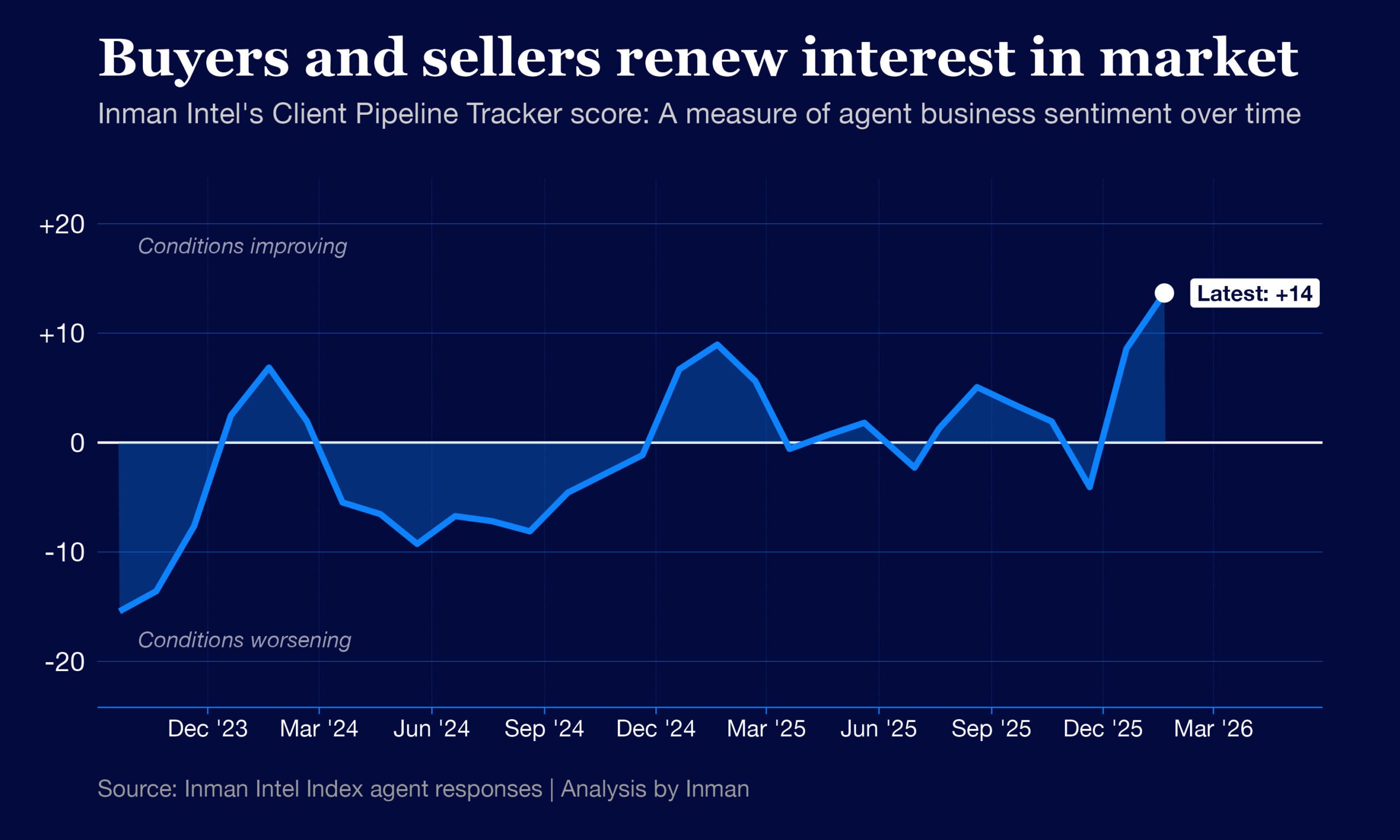

The share of Intel Index survey agent respondents who say their client pipelines are better off than they were a year ago is now about as large as the share who say their pipelines have worsened. And this new development has helped propel Intel’s Client Pipeline Tracker metric to its highest level since we began surveying agents during the real estate doldrums of 2023.

Client Pipeline Tracker score in January: +14

- Previous score: +9 in December

- 3 months ago: +2 in October

Chart by Daniel Houston

These improving business conditions on the ground could be early signs of what agents have long expected: that easing mortgage rates and slowing price growth will, at some point, bring meaningful numbers of potential homebuyers and sellers back into the fold.

But it will be months before we learn whether these early signs will convert into a stronger spring and summer transaction market.

In recent years, agent optimism in January hasn’t panned out. But it’s also true that agents were less optimistic at this time in 2024 and 2025 — and had fewer clients in the pipeline to back up their hopes than they do today.

Intel breaks down all the granular survey details that inform the score in this week’s report.

Conditions on the ground

Intel’s Client Pipeline Tracker is a compilation of how agents feel about their buyer and seller pipelines — both over the past year and in the near future.

Intel described the methodology in this post, but here’s a quick refresher on how to interpret the scores.

- A score of 0 represents a neutral period in which client pipelines are neither improving nor worsening.

- A positive score reflects a market in which client pipelines have been improving, or are widely expected to improve in the next 12 months. The higher the rating, the more confident agents are that conditions are moving in a positive direction.

- A negative score suggests client pipeline conditions are worsening, or are widely expected to get worse in the year to come.

A significantly positive combined score falls somewhere around the +20 mark. This type of score would signify that much of the industry is in agreement that pipelines are improving and will continue to improve.

A significantly negative combined score, on the other hand, falls closer to -20. That’s a bit lower than where the industry stood in September 2023, the first time Intel surveyed agents about their pipelines.

For each of the four individual components that go into the score, results as high as +50 or as low as -50 are sometimes observed.

Here are the component scores from the most recent survey, and how each sentiment category changed from the previous one.

Tracker component scores

December → January

- Present buyer pipelines: -17 → -7

- Future buyer pipelines: +19 → +22

- Present seller pipelines: -7 → +1

- Future seller pipelines: +19 → +22

Across all four component categories, these are the highest scores recorded since Intel first started surveying agents about their client pipelines in September 2023.

It’s also striking just how much of the recent movement in the score has been driven by real conditions on the ground, rather than just expectations for the months ahead.

Because the scores are meant to be forward-looking, the future outlook components carry twice the weight of present pipeline components.

Despite this weighting methodology, it’s the present business conditions that have driven the overall score higher in recent months. It’s a clear sign that agents are seeing real momentum in terms of both buyer and seller clients expressing interest in entering the market.

- The share of agent respondents who reported worsening buyer pipelines year-over-year dropped from 47 percent in October to 32 percent in January.

- Meanwhile, the share of agents who told Intel their buyer pipelines had improved jumped from 16 percent to 27 percent over the same period.

On the listing side, agents surveyed by Intel have actually reached positive territory in year-over-year pipeline sentiment.

- The share of agent respondents who reported their seller pipelines had worsened over the past year declined from 36 percent in October to 24 percent in January.

- On the other hand, the share of agent respondents who said their seller pipelines ticked up from 27 percent in October to 32 percent in January.

As these present-day pipeline conditions improved, agents appear to be slightly adjusting their forward-looking expectations for the year ahead. But it’s worth noting that these recent pipeline improvements appear to be fulfilling the expectations that agents have expressed in surveys for months.

- A full 43 percent of agent respondents in October said they expected their buyer pipelines to be heavier in a year, compared to only 16 percent who expected their buyer pipelines to be lighter.

- By January, 53 percent of agent respondents were expecting some kind of growth in their buyer pipelines in the year ahead, while fewer than 11 percent expected buyer pipelines to shrink.

- Still, only 5 percent of agents told Intel they expected “significant” improvement in their buyer pipelines in the year to come — not a meaningful difference from previous months.

In other words, agents are encouraged by the interest they’re getting from potential buyer and seller clients ahead of what will prove to be an important spring market for many of their businesses. But they’re going to need to see more before they meaningfully move from cautious optimism to a more bullish outlook.

Intel will continue to track agent pipeline health closely in the months ahead.

Methodology notes: This month’s Inman Intel Index survey was set to run from Jan. 22-Feb. 4, 2026, and had received 427 responses by Thursday afternoon. These results are preliminary and may be revised. The entire Inman reader community was invited to participate, and a rotating, randomized selection of community members was prompted to participate by email. Users responded to a series of questions related to their self-identified corner of the real estate industry — including real estate agents, brokerage leaders, lenders and proptech entrepreneurs. Results reflect the opinions of the engaged Inman community, which may not always match those of the broader real estate industry. This survey is conducted monthly.

Email Daniel Houston

Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Boost in buyers closes 2025 on high note: Client Pipeline Tracker

Boost in buyers closes 2025 on high note: Client Pipeline Tracker

The portal-war endgames that real estate agents actually want: Intel

The portal-war endgames that real estate agents actually want: Intel

If not Zillow, then who? Agents spar over preferred portal-war victors

If not Zillow, then who? Agents spar over preferred portal-war victors

Non-Realtor access has altered the MLS landscape. How common is it?

More in Inman Intel

Non-Realtor access has altered the MLS landscape. How common is it?

More in Inman Intel

Non-Realtor access has altered the MLS landscape. How common is it?

Non-Realtor access has altered the MLS landscape. How common is it?

If not Zillow, then who? Agents spar over preferred portal-war victors

If not Zillow, then who? Agents spar over preferred portal-war victors

The portal-war endgames that real estate agents actually want: Intel

The portal-war endgames that real estate agents actually want: Intel

Boost in buyers closes 2025 on high note: Client Pipeline Tracker

Boost in buyers closes 2025 on high note: Client Pipeline Tracker

Read next

Read Next

10 easy daily marketing moves that build your brand and business

10 easy daily marketing moves that build your brand and business

Boost in buyers closes 2025 on high note: Client Pipeline Tracker

Boost in buyers closes 2025 on high note: Client Pipeline Tracker

Non-Realtor access has altered the MLS landscape. How common is it?

Non-Realtor access has altered the MLS landscape. How common is it?

AI chatbots are taking agents from newbie to pro in record time

AI chatbots are taking agents from newbie to pro in record time