Softening rates opened the door for 4.8 million borrowers to refinance their mortgages in January, the highest level in four years. However, affordability levels remain below pre-pandemic levels.

Inman On Tour

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

Although mortgage rates are still nowhere near the often-cited magical number of 5 percent, incremental decreases throughout January lifted affordability to the highest level since 2022.

During the week of Jan. 9, the average 30-year fixed mortgage rate declined to 6.04 percent. According to the global technology and data firm Intercontinental Exchange (ICE), this decrease increased the number of homeowners eligible for refinancing by 20 percent, affecting 4.8 million people. Despite recent rate increases, the firm said current trends are still an improvement over the 6.875 percent to 6.99 percent rate that 1.3 million homeowners have.

“Even small reductions toward 6 percent rates can significantly boost affordability, particularly for homeowners who could refinance into a lower rate and monthly payments,” ICE Head of Mortgage and Housing Market Research Andy Walden said in a written statement on Monday. “When rates hit 6.04 percent on Jan. 9 … affordability hit its best level in four years.”

The rate drop reduced the monthly principal and interest payment needed to purchase the average-priced home by 7 percent, or $164, to $2,091. That payment represents 27.8 percent of a median household’s monthly income — only a few percentage points away from the widely-accepted 30 percent affordability threshold. However, ICE said there’s still plenty of room to push home price-to-income ratios down.

The current ratio is at 4.8:1, well above the pre-pandemic average of 4:1.

“Affordability remains structurally challenged, with home prices still elevated relative to incomes and meaningful differences emerging across regions and borrower segments,” Walden said. “To revert back to pre-pandemic home price-to-income ratios, household incomes would need to rise a little over 15 percent, assuming home prices remain flat.”

On the refinance side, a growing number of homeowners are grappling with negative equity.

Negative equity rates reached the highest level since early 2018, with more than 1.1 million homeowners underwater by the end of 2025. The majority of those homeowners made their purchases in 2022 or later, and used Federal Housing Administration (FHA) or Department of Veterans Affairs (VA) loans. The South has been disproportionately impacted, with several major markets in the region having more than 1 in 10 mortgaged homes underwater.

ICE Mortgage Technology President Bob Hart said the report reflects stress points in the market that lift some borrowers and bury others.

“Today’s market is full of cross currents — borrowers responding quickly to rate shifts, affordability improving for some but not others, and pockets of rising credit stress,” he said.

Email Marian McPherson

Topics: homebuying Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Why secondary markets are America’s real real estate story

Why secondary markets are America’s real real estate story

President Trump argues for keeping home prices high, borrowing costs low

President Trump argues for keeping home prices high, borrowing costs low

The affordable housing crisis isn't just financial. It's political

The affordable housing crisis isn't just financial. It's political

Markets in the South emerge as big losers in annual home price growth

More in Mortgage

Markets in the South emerge as big losers in annual home price growth

More in Mortgage

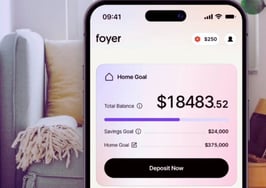

Prosperity Home Mortgage brings on first-time buyer platform Foyer

Prosperity Home Mortgage brings on first-time buyer platform Foyer

President Trump argues for keeping home prices high, borrowing costs low

President Trump argues for keeping home prices high, borrowing costs low

Zillow terminates approximately 3% of staff (but it's not shrinking)

Zillow terminates approximately 3% of staff (but it's not shrinking)

Trump nominates Kevin M. Warsh as next Fed chair

Trump nominates Kevin M. Warsh as next Fed chair

Read next

Read Next

Investor calls CoStar's residential project a 'fiasco,' slams Homes.com spending

Investor calls CoStar's residential project a 'fiasco,' slams Homes.com spending

Why secondary markets are America’s real real estate story

Why secondary markets are America’s real real estate story

The affordable housing crisis isn't just financial. It's political

The affordable housing crisis isn't just financial. It's political

Ryan Serhant: Real estate's future is SERHANT. vs. Compass — and I'm ready to win

Ryan Serhant: Real estate's future is SERHANT. vs. Compass — and I'm ready to win