- Home

- Investing

- Stocks

If you've built significant wealth through stock in a single company, deciding your next move could have you petrified. This decision-making framework will help you get unstuck.

By

Zachary Ashburn, CFP®, EA, AFC®

published

10 February 2026

in Features

By

Zachary Ashburn, CFP®, EA, AFC®

published

10 February 2026

in Features

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

- Copy link

- X

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Contact me with news and offers from other Future brands Receive email from us on behalf of our trusted partners or sponsors By submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over.You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Signup +

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Signup +

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Signup +

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Signup +

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Signup +

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Signup +

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Signup +

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Signup +

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Signup + An account already exists for this email address, please log in. Subscribe to our newsletter

If you have more than a million dollars of concentrated stock, you may feel stuck.

You might even feel uncomfortable admitting that. It might feel wrong to say you feel scared about money when you're seeing the biggest numbers of your life on your statements.

On paper, it looks like a good problem to have. But emotionally and financially, it feels precarious.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

CLICK FOR FREE ISSUE

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sign upI've seen this tension time and time again. Investors know they've built meaningful wealth, yet they're uneasy. They're unsure whether to sell, diversify, hedge or hold on.

Meanwhile, with the whole world shouting about investment and tax strategies, it's easy to become paralyzed with indecision.

Over time, we've found that the problem isn't a lack of tactics. It's the order in which people approach the decision.

That's why we use a planning framework we call D.E.L.T.A. to help families think through concentrated stock in a more intentional and orderly way.

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

Why concentrated stock decisions are so hard

The average conversation about large stock positions dives straight into tactics: Taxes, exchange funds, options, charitable planning or diversification rules of thumb. These are all useful tools if they are applied thoughtfully and in the right context.

However when tactics come first, people often get stuck weighing questions such as:

- Should I sell now or wait?

- What if I trigger a big tax bill?

- What if this stock keeps going up after I diversify?

There's also no shortage of conflicting advice. Some sources say anything over 5% of your portfolio is too much. Others say 10%, 20% or more might be fine. We hear Warren Buffett quotes such as "concentration builds wealth" and wonder how to possibly evaluate the trade-offs.

The D.E.L.T.A. framework is designed to slow the process down and put decisions in the proper order.

D: Develop your family's goals purposefully

The first step is developing goals and it's the most commonly skipped. It's pretty easy to make a list of investment strategies, but it's pretty hard to reflect on what you want your life to look like.

Goals often start as surface-level statements like "I want to retire early" or "I want to travel more." Those are fine starting points, but they're not enough to drive good decisions.

Set aside space to develop the aspects of how you want your life to feel and the actions that would let you know when you've gotten there.

Until you understand how you want to live, what flexibility you need and what trade-offs you're willing to make, it's almost impossible to evaluate a concentrated stock position intelligently.

Missing this step is what leads to paralysis for stockholders. Timing stock sales, planning corporate exits and coordinating income strategies all rely on having a clear end-state in mind. There may be (legitimate) concerns about the stock itself, but anxiety also comes from the lack of direction.To work on your family's goals, consider holding family meetings and working with advisers and counselors through big life transitions.

At our firm, we've developed a "personal vision" exercise to assist clients with moving from surface-level goals to long-term targets.

E: Evaluate the stock position

Once your goals are clear, the next step is evaluating the stock position itself.

Since there's no brightline test for how much is too much to hold (and, as mentioned above, the popular rules-of-thumb vary widely) it can be helpful to probe a little deeper with questions like these:

- Would you be okay if this stock declined significantly (or to zero)?

- Is your income still tied to the same company?

- How volatile is the business, really?

- Would you buy this stock today if you were starting from cash?

- Are you building other assets around it to balance the risk?

These questions help put the concentration in perspective. In many cases, people realize they're carrying more risk than they intended often without being compensated for it.

While the data supports this concern, too often the default investment conversation centers around "picking winners." For investors with large concentrated stock positions, the "winner" has already come through.

Over the past several decades, a large percentage of individual U.S. stocks have underperformed the broader market or lost money altogether. Even among high-performing stocks, strong early performance does not reliably persist over time.

In the investing world we often use the term "risk" to describe volatility, the amount that a given investment is likely to move up or down.

Concentrated stock holders might feel okay with moves in stock prices, but the questions we ask are a helpful nudge toward assessing a different risk — not achieving your personal goals when you hope to.

The odds that you're holding the long-term winner are rarely as favorable as they feel at the moment.

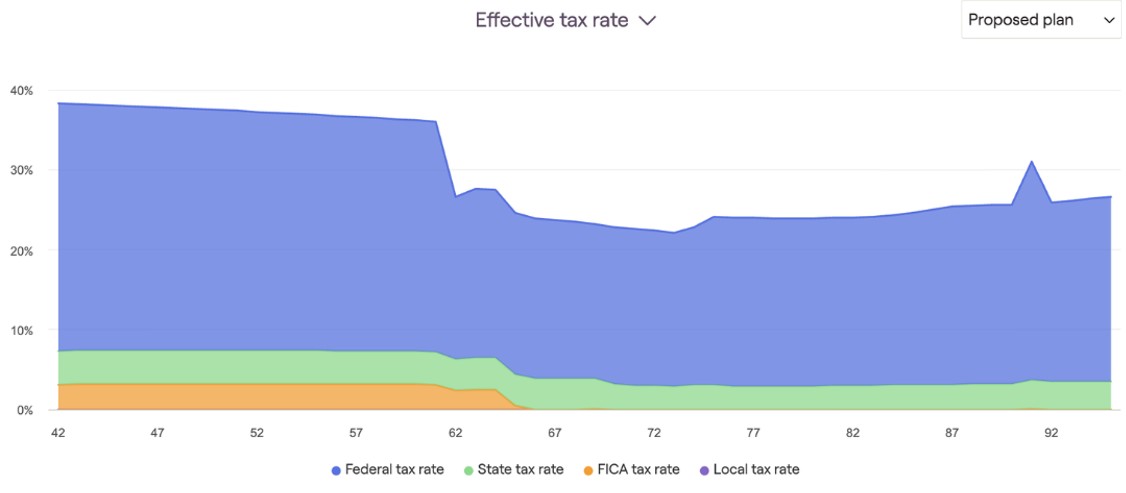

L: Looking through a tax-efficient lens

Investors often hold off on selling concentrated positions in an effort to avoid a big tax bill. However, with clear goals in mind and a healthy perspective on the stock position, we can more easily plan moves tax-efficiently.

A tax-efficient lens means looking at decisions and tactics across a lifetime, not just the current year. Expected future income, retirement timing, inherited assets and account types all matter. Someone in peak earning years faces a very different set of trade-offs than someone approaching retirement or experiencing a liquidity event.

When taxes are viewed in isolation, fear and avoidance often take over. When they're mapped out over time and driven by personal goals, decisions tend to become clearer and more manageable. There is a long list of tactics investors could employ:

- Donor-advised funds

- Charitable trusts

- Exchange funds/351 exchanges

- Direct indexing

- Long/short funds

Starting with this list is overwhelming. But having identified where you want to end up, the overwhelming list begins to look like a more appealing menu of options.

T: To arrive at a core portfolio

Only after the first three steps are complete does it make sense to talk about specific strategies. Viewed through the tax-efficient lens, we select the tactics that help you arrive at a diversified core portfolio.

Those strategies generally fall into three categories:

Hedging. To manage risk and buy time

Giving. For those with charitable goals who want to reduce concentration efficiently

Diversifying. Whether gradually or immediately, depending on the situation

No one of these will be the single strategy for a concentrated stock holder. What matters is how they fit together over time to support the goals you've already defined.

At this stage, it's also important to remember a key mindset shift: if you're holding a large concentrated position, you've already won.

The objective is no longer to pick the next winner — it's to more reliably achieve your family's goals.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

A: Achieve your family's goals more reliably

Reliably achieving your family's goals will be a function of two things working in tandem: A sound portfolio and a sound withdrawal strategy. The work of moving from a concentrated stock position to a diversified portfolio begins to build the first. The second is born out of a tax-efficient income plan that matches the timeline of the goals you've set.

Put differently, this is the work of a thorough financial plan. A long-term plan should account for the goals you've identified, show that you are on track to have the income needed to support them and display how you're generating that income in the most tax-efficient way possible.

Moving past paralysis

Managing your concentrated stock doesn't have to be an all-or-nothing decision. But it does require structure, patience and clarity.

Our D.E.L.T.A. framework has become a useful tool to remind us how to take decisions and have conversations in sequence to encourage good outcomes.

When decisions are made in the right order, people tend to feel more confident, more intentional and far less prone to paralysis. That clarity may be worth more than any single tactic and it will almost certainly amplify the effectiveness of the tactics you use along the way.

Related Content

- How Selling a Losing Stock Position Can Lower Your Tax Bill

- For a Concentrated Stock Position, Ask Your Adviser This

- Managing a Concentrated Stock Position: Too Much of a Good Thing

- Coast FI Planning: High Earners' Secret Retirement Weapon

- Escaping the New Golden Handcuffs: A Plan for Executives

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

TOPICS Adviser Intel Get Kiplinger Today newsletter — freeContact me with news and offers from other Future brandsReceive email from us on behalf of our trusted partners or sponsorsBy submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over. Zachary Ashburn, CFP®, EA, AFC®Social Links NavigationChief Planning Officer, Reach Strategic Wealth

Zachary Ashburn, CFP®, EA, AFC®Social Links NavigationChief Planning Officer, Reach Strategic WealthZach is co-founder and Chief Planning Officer of Reach Strategic Wealth, where he specializes in tax-efficient corporate exit planning for executives. With over a decade of experience as a professional adviser, he is passionate about bridging the critical gap in quality tax planning that exists between traditional investment advisors and tax preparers. Beyond his professional expertise, Zach brings a unique perspective shaped by his personal journey as a former foster parent and current adoptive parent. He actively mentors others navigating their own adoption processes, combining his strategic planning skills with genuine compassion for families in transition.

Latest You might also like View More \25b8

These Retirement Planning Steps Protect the Life You Want

These Retirement Planning Steps Protect the Life You Want

Fixed Indexed Annuities and Bonds: The Perfect Match?

Fixed Indexed Annuities and Bonds: The Perfect Match?

'Fee-Only' and 'Fiduciary': Why You Must Know the Difference

'Fee-Only' and 'Fiduciary': Why You Must Know the Difference

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a Financial Adviser: This Is Why a Second (Gray) Divorce Could Cost You Big-Time

I'm a Financial Adviser: This Is Why a Second (Gray) Divorce Could Cost You Big-Time

A Matter of Trustees: Is Your Spouse the Best Person to Manage the Kids' Trusts?

A Matter of Trustees: Is Your Spouse the Best Person to Manage the Kids' Trusts?