Quick Read

- Fannie Mae and Freddie Mac have increased their retained mortgage portfolios by $55 billion since May 2025, growing combined holdings from $178.5 billion to $233.6 billion.

- Purchasing more mortgage-backed securities (MBS) and loans may help lower mortgage rates by easing investor demand pressures, with Fannie and Freddie buying $13 billion monthly in the second half of 2025.

- Industry groups urge raising Fannie and Freddie’s MBS purchase caps to address the elevated spread between 30-year mortgage rates and 10-year Treasury yields, which impacts mortgage rates and affordability.

- The mortgage purchases could also boost Fannie and Freddie’s bottom lines, making them more attractive to investors as the Trump administration considers a public offering to sell part of the government’s 80% stake in the mortgage giants.

Monthly purchases of $13 billion in mortgages and MBS may be taking pressure off mortgage rates — and setting the stage for a more attractive public offering.

Mortgage giants Fannie Mae and Freddie Mac have been quietly growing their retained mortgage portfolios by billions of dollars in recent months — a move that might not only be taking some pressure off of mortgage rates, but paving the way for a public offering.

Fannie, Freddie and their regulator, the Federal Housing Finance Agency, “have been tight lipped” about the $55 billion in mortgage-backed securities and mortgage loans they’ve added to their portfolio since May, said Bloomberg’s Scott Carpenter, who spotted the trend.

But Trump administration officials, including FHFA Director Bill Pulte and Treasury Secretary Scott Bessent, have acknowledged they’re looking into ways the government could sell off part of its stake in the companies through a public offering.

“They have [a public offering] in mind, as well as other possible objectives, like lowering mortgage rates,” Carpenter said Monday on Bloomberg TV.

“They’re thinking, how do we make this possible?,” he said. “One way to do that could be buying more mortgage bonds and mortgage loans, increasing [Fannie and Freddie’s] earnings [and] presenting better profitability, so that when it comes time to do an offering, investors like what they see.”

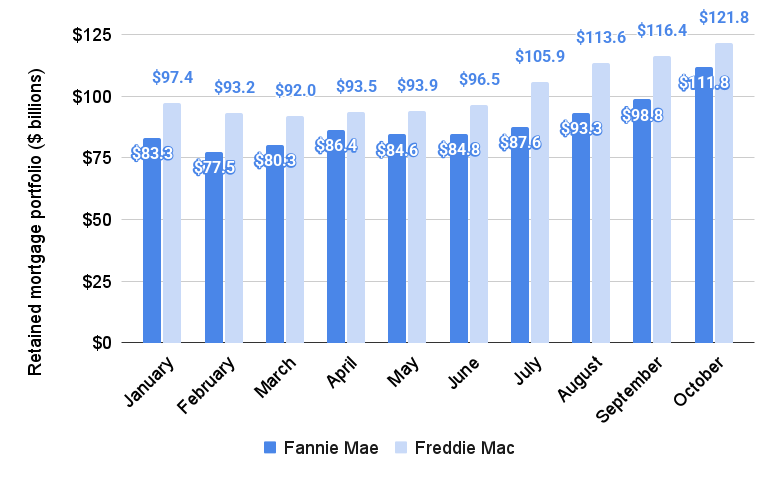

Fannie and Freddie retained mortgages and MBS

Fannie and Freddie’s combined retained mortgage portfolio grew by 31 percent from May to October, from $178.5 billion to $233.6 billion. Source: Fannie Mae and Freddie Mac monthly volume surveys.

While some economists and real estate industry trade groups have worried that privatizing Fannie and Freddie could mean higher mortgage rates for homebuyers, the Trump administration has signaled that it’s more interested in monetizing the mortgage giants than privatizing them.

Instead of releasing Fannie and Freddie from government conservatorship, the Trump administration is planning to sell a small slice of its 80 percent stake in the companies, Pulte said in October.

Trump himself has promised that the government will continue to maintain an “implicit guarantee” of Fannie and Freddie’s obligations — which could help keep mortgage rates low, but expose taxpayers to future losses.

Fannie and Freddie don’t make mortgage loans themselves, but help make rates more affordable by providing guarantees to investors in mortgage-backed securities who fund most home loans.

Most of the impact the companies have on the mortgage market comes through those guarantees. Through Sept. 30, Freddie Mac has provided guarantees on $219 billion in purchase mortgages this year, with Fannie Mae backing another $186 billion in purchase loans.

But instead of packaging loans into mortgage-backed securities (MBS) and selling them to investors, Fannie and Freddie can retain some of those loans in their own investment portfolios. Fannie and Freddie’s retained mortgage portfolios also include their own MBS, but relatively minuscule levels of “private-label” MBS that generated losses that helped put the companies into conservatorship in 2008.

Because mortgage rates are largely determined by MBS investor demand, Fannie and Freddie’s purchases of loans and their own MBS might be helping take a little pressure off of mortgage rates.

During the pandemic, the Federal Reserve’s MBS purchases, which peaked at $40 billion per month, were part of a “quantitative easing” program that helped push mortgage rates to historic lows.

Fannie and Freddie, by comparison, have been buying up mortgages and MBS at a rate of $13 billion per month in the second half of the year.

“A lot of investors I talked to [say] it’s on a trajectory to continue growing into next year,” Carpenter said of Fannie and Freddie’s appetite for buying mortgages. “Citigroup is expecting them to add $100 billion.”

In October, two groups representing independent and community-based mortgage lenders wrote to Pulte and Bessent urging that Fannie and Freddie be granted more leeway to buy their own MBS.

As long as a key metric — the “30-10 spread” — exceeds 170 basis points (1.7 percentage points), Fannie and Freddie should each have the ability to purchase up to $300 billion in MBS, the Community Home Lenders of America (CHLA) and the Independent Community Bankers of America (ICBA) argued.

The “30-10 spread” between 30-year fixed-rate mortgages and 10-year Treasury yields averaged less than two percentage points during the decade before the pandemic. But it widened to three percentage points at times in 2022 and 2023, adding to the pain of rising mortgage rates.

In 2023, the National Association of Realtors joined with CHLA and ICBA in calling for raising caps on Fannie and Freddie’s MBS purchases, and for the Fed to put “quantitative tightening” on hold as a strategy for reducing the 30-10 spread.

At 2.05 percentage points as of Dec. 12, the 30-10 spread is approaching its historical average — one factor helping mortgage rates decline to a 2025 low of 6.12 percent on Oct. 28, according to lender data tracked by Optimal Blue.

Fed still holds $2 trillion in mortgages on its books

Although the Fed stopped buying mortgages in 2022 and has been trimming its balance sheet ever since, it still holds more than $2 trillion in MBS and nearly $4.2 trillion in Treasurys on its books.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Fannie and Freddie build net worths for planned Q2 2026 public offering

Fannie and Freddie build net worths for planned Q2 2026 public offering

Don't merge Fannie and Freddie, says their biggest investor

Don't merge Fannie and Freddie, says their biggest investor

Fannie, Freddie moving to adopt more inclusive credit scores

Fannie, Freddie moving to adopt more inclusive credit scores

GAO to look into claims Pulte has weaponized Fannie and Freddie

More in Select

GAO to look into claims Pulte has weaponized Fannie and Freddie

More in Select

Binsr Inspect proves AI can improve transactions: Tech Review

Binsr Inspect proves AI can improve transactions: Tech Review

Here's the real secret to increasing your lead conversion rates

Here's the real secret to increasing your lead conversion rates

Analyst: Portals like Zillow face 'long-term risk' from Google real estate experiment

Analyst: Portals like Zillow face 'long-term risk' from Google real estate experiment

Zillow stalemate with Chicago's MLS looks like it's coming to a head

Zillow stalemate with Chicago's MLS looks like it's coming to a head

Read next

Read Next

EXp CEO Leo Pareja: We aren’t waiting for NAR on referrals

EXp CEO Leo Pareja: We aren’t waiting for NAR on referrals

Fannie, Freddie moving to adopt more inclusive credit scores

Fannie, Freddie moving to adopt more inclusive credit scores

NAR spent big on exec salaries, marketing and lobbying in 2024

NAR spent big on exec salaries, marketing and lobbying in 2024

GAO to look into claims Pulte has weaponized Fannie and Freddie

GAO to look into claims Pulte has weaponized Fannie and Freddie