Quick Read

- United Wholesale Mortgage (UWM) will acquire RoundPoint Mortgage Servicing’s parent, Two Harbors Investment Corp., in a $1.3 billion all-stock deal expected to close in Q2 2026, pending approvals.

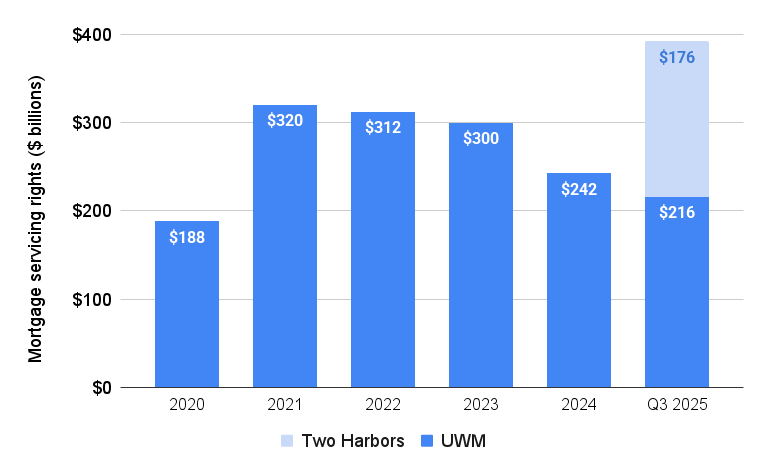

- The acquisition will nearly double UWM’s mortgage servicing rights portfolio from $216 billion to nearly $400 billion, making it the eighth-largest U.S. mortgage servicer.

- UWM CEO Mat Ishbia anticipates increased profitability, cash flow, and operational efficiencies, with expected annual synergies of $150 million post-merger.

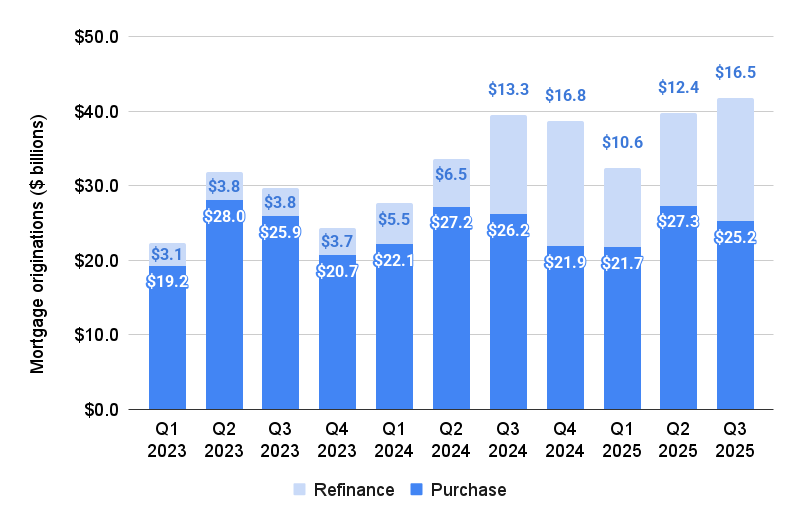

- UWM grew Q3 2025 refinancing volume by 33 percent to $16.5 billion, leveraging AI and technology to scale amid declining mortgage rates, despite servicing only 2 percent of U.S. mortgages.

The all-stock deal to acquire the parent of RoundPoint Mortgage Servicing would nearly double UWM’s servicing portfolio to nearly $400 billion, if it closes as expected in Q2 2026.

The nation’s biggest provider of home loans, United Wholesale Mortgage, is jumping on the mortgage servicing bandwagon with a deal to acquire RoundPoint Mortgage Servicing’s parent company in a $1.3 billion all-stock transaction.

The boards of both companies’ parents — UWM Holdings Corporation and Two Harbors Investment Corp. — have approved the deal, which is expected to close in the second quarter of 2026 pending approval by regulators and Two Harbors’ shareholders.

If the deal closes as expected, UWM will nearly double the size of its mortgage servicing rights (MSR) portfolio, which totaled $216 billion as of Sept. 30, with the addition of Two Harbors’ $176 billion portfolio.

Mortgage loan servicers collect monthly payments from homeowners on behalf of investors who own the loans, earning fees that can smooth out the ups and downs of the mortgage business.

Lenders who retain the rights to service their own loans also have an edge over other lenders when homeowners from whom they collect payments are ready to refinance.

UWM’s biggest rival, Rocket Companies, now services about $2 trillion in mortgage debt owed by nearly 10 million borrowers after closing a $14.2 billion acquisition of mortgage servicing giant Mr. Cooper on Oct. 1. That deal, and Rocket’s $1.8 billion acquisition of real estate brokerage Redfin, are part of a long-term goal to capture 8 percent of the purchase loan market and 20 percent of refinancing,

In a similar marriage of a major mortgage lender and a loan servicer, last month Guild Mortgage became a sister company of Lakeview Loan Servicing, the nation’s largest nonbank mortgage servicer, when parent company Guild Holdings Co. was acquired for $1.3 billion by Bayview Asset Management.

Collecting payments on $392B in mortgages

By the time the Two Harbors deal closes, UWM expects to be servicing more than $400 billion in mortgages, which would make it the eighth largest U.S. mortgage loan servicer (both companies’ MSR portfolios totaled $392 billion as of Sept. 30).

By the time the Two Harbors deal closes, UWM expects to be servicing more than $400 billion in mortgages, which would make it the eighth largest U.S. mortgage loan servicer (both companies’ MSR portfolios totaled $392 billion as of Sept. 30).

While UWM’s servicing portfolio would still only be about one-fifth the size of Rocket’s, UWM CEO Mat Ishbia says acquiring Two Harbors will boost profitability and cash flow, create a stronger balance sheet and streamline operations.

After Rocket announced its plans to acquire Mr. Cooper in March, UWM promptly canceled its subservicing contract with Mr. Cooper and signed a long-term agreement with ICE Mortgage Technology in April to bring its loan servicing in-house.

Mat Ishbia

“The timing of doubling our servicing book as we bring servicing in-house is the perfect alignment, allowing us to deliver meaningful upside to stockholders and leverage increased cash flow to invest deeper into the broker network,” Ishbia said in a statement on Wednesday.

In addition to the fee income that loan servicing generates — investors paid UWM $636.7 million to service their loans last year — the companies expect to realize cost and revenue synergies of $150 million per year after the deal closes.

Bill Greenberg

“Scale has become more important than ever in the mortgage industry,” Two Harbors President and CEO Bill Greenberg said in a statement. “We are very excited to partner with the largest mortgage lender in the country, bringing our expertise in MSR investing and servicing through the RoundPoint platform.”

The deal will also boost UWM’s public float — the number of shares available to the public — by 93 percent, to 513 million shares, making it easier for institutional investors to take a big stake in the company.

Shareholders in Two Harbors will receive 2.3328 shares of UWMC Class A Common Stock for each of their Two Harbors shares, representing an $11.94 per share value based on UWMC’s closing price as of December 16, 2025. That’s a 21 percent premium over the average price of Two Harbor shares over the last 30 days.

If the deal goes through on those terms, current UWM shareholders will own approximately 87 percent of the combined company, while Two Harbors shareholders will own approximately 13 percent.

The merger should also provide more leads for mortgage brokers who work with UWM, in the form of borrowers now serviced by RoundPoint.

Because UWM is a wholesale lender that works with independent mortgage brokers, Ishbia has in the past questioned the conventional wisdom that loan servicers have an advantage in competing for borrowers who are ready to refinance.

Although UWM only owned the servicing rights to about 2 percent of U.S. mortgages during the second quarter, it handled 11 percent of refinancings, Ishbia pointed out in August.

“For us, [those statistics] really disprove the age-old theory that you must have the servicing to do the refi,” Ishbia said at the time.

UWM grew Q3 refinancing by 33%

UWM mortgage originations by quarter. Source: UWM earnings reports.

UWM’s investments in AI and other technology allow it to scale up quickly when mortgage rates drop. Declining mortgage rates in September helped UWM boost refinancing volume by 33 percent from Q2 to Q3, to $16.5 billion.

“We’ve been prepared for a rate rally for years, and the third quarter gave us a little bit of a glimpse of what it would look like,” Ishbia said on UWM’s Q3 earnings call.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Topics: lenders Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Mortgage lenders are turning to AI to play in the big leagues

Mortgage lenders are turning to AI to play in the big leagues

AI key to growing Rocket, Redfin and Mr. Cooper under one roof

AI key to growing Rocket, Redfin and Mr. Cooper under one roof

AI helps UWM seize the day, make the most loans in 4 years in Q3

AI helps UWM seize the day, make the most loans in 4 years in Q3

Bayview merger positions Guild Mortgage for refinancing boom

More in Mortgage

Bayview merger positions Guild Mortgage for refinancing boom

More in Mortgage

Freddie Mac taps retired Deloitte consultant Kenny Smith as CEO

Freddie Mac taps retired Deloitte consultant Kenny Smith as CEO

Fannie Mae and Freddie Mac are quietly stockpiling mortgages

Fannie Mae and Freddie Mac are quietly stockpiling mortgages

FHA will back loans up to $1.249M in high-cost markets next year

FHA will back loans up to $1.249M in high-cost markets next year

Fed patches a potential chink in armor protecting its independence

Fed patches a potential chink in armor protecting its independence

Read next

Read Next

Mortgage lenders are turning to AI to play in the big leagues

Mortgage lenders are turning to AI to play in the big leagues

AI helps UWM seize the day, make the most loans in 4 years in Q3

AI helps UWM seize the day, make the most loans in 4 years in Q3

How boutique brokerages can thrive as big brands merge

How boutique brokerages can thrive as big brands merge

Buyer's agent commissions see rebound in wake of settlement

Buyer's agent commissions see rebound in wake of settlement