Markets across the Midwest and South offer enviable affordability; however, lower housing prices can reflect deeper issues, such as economic disinvestment and discriminatory housing policies.

Inman Connect

Invest in yourself, grow your business—real estate’s biggest moment is in San Diego!

Invest in yourself, grow your business—real estate’s biggest moment is in San Diego!

Low housing costs are hiding an uncomfortable truth, according to Redfin’s latest report.

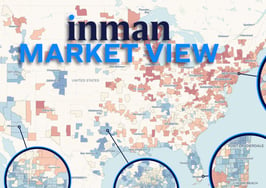

The South and Midwest are filled with smaller, low-cost markets where homebuyers can easily spend well below 30 percent of their monthly income on housing costs.

Homebuyers in Bellefontaine Neighbors and Ferguson — two cities in the Greater St. Louis metro — spend 16 percent to 17.9 percent of their monthly income on housing costs, making them the most affordable markets in the country.

Buyers in Detroit (17.9 percent), West Mifflin, Pennsylvania (19.1 percent), Garfield Heights, Ohio (19.8 percent), and Spanish Lake, Missouri (20 percent), and several other mid-size metros throughout Louisiana and Mississippi, also spend 20 percent or less on housing.

These markets, Redfin Senior Economist Asad Khan said, offer younger homebuyers an opportunity to become homeowners, a goal that often feels like a “pipe dream” considering steadily rising median home prices, student loan balances and other consumer debts.

Asad Khan

“Affordability is top of mind for many people today,” he said. “But believe it or not, there are still plenty of areas — mostly in the Rust Belt and the South — where buying a home is financially comfortable.”

However, these affordability metrics can obfuscate a deeper story. These areas, the report said, are bearing the marks of decades of economic disinvestment and discriminatory housing policies, which keep home values low and hinder homeowners from making improvements to their aging homes.

These areas also offer fewer educational and career opportunities, potentially locking residents into a cycle of poverty.

“In many of the nation’s most affordable cities, homeownership may look attainable for local households on paper, but the reality is often more complicated,” the report read. “Many cities have poverty rates far above the national average and house a disproportionate share of underserved groups. So, even though the typical household can afford its monthly payments, not everyone can.”

The report also offered a silver lining of sorts, saying that early-pandemic boomtowns are experiencing price slowdowns, making them more affordable than they’ve been in years.

Leander, an Austin, Texas, suburb, is one of the top 25 most affordable cities, with homebuyers spending 23.3 percent of their income on monthly housing costs.

“Many people who moved to the region for its sunshine and affordability during the pandemic have since moved away, creating a surplus of inventory and helping prices drop from their peak,” the report said. “A significant share of people were able to move because they worked remotely, but left when return-to-office mandates pulled them elsewhere.”

As for 2026, Khan predicts affordability will “slowly improve” nationwide, giving homebuyers more choice wherever they decide to live.

“Rising wages and declining costs may bring some life back to the market in 2026, but until homebuilding catches up to years of unmet demand, affordability will remain a challenge,” he said in the report. “The best way to make homebuying affordable — especially for younger generations — is to make homebuilding easier and provide financial and social support to populations in need.”

Email Marian McPherson

Topics: first-time homebuyers | homebuying | Redfin Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Better Homes and Gardens: Homebuyers 'won’t settle for less'

Better Homes and Gardens: Homebuyers 'won’t settle for less'

Gen Z is ready to buy: Boost your business by mastering co-buying

Gen Z is ready to buy: Boost your business by mastering co-buying

Homebuyer demand stays strong as mortgage rates stabilize near 2025 lows: MBA lender surveys

Homebuyer demand stays strong as mortgage rates stabilize near 2025 lows: MBA lender surveys

The Midwest is best? Why buyers flocked to the Heartland in 2025

More in Markets & Economy

The Midwest is best? Why buyers flocked to the Heartland in 2025

More in Markets & Economy

The Midwest is best? Why buyers flocked to the Heartland in 2025

The Midwest is best? Why buyers flocked to the Heartland in 2025

Watchdog: Agents earn too little. Consumers pay too much

Watchdog: Agents earn too little. Consumers pay too much

Interactive: A reversal in this major region stalled the inventory rally

Interactive: A reversal in this major region stalled the inventory rally

How the winter market creates soft power plays for buyers and sellers

How the winter market creates soft power plays for buyers and sellers

Read next

Read Next

NAR spent big on exec salaries, marketing and lobbying in 2024

NAR spent big on exec salaries, marketing and lobbying in 2024

How boutique brokerages can thrive as big brands merge

How boutique brokerages can thrive as big brands merge

Better Homes and Gardens: Homebuyers 'won’t settle for less'

Better Homes and Gardens: Homebuyers 'won’t settle for less'

Gen Z is ready to buy: Boost your business by mastering co-buying

Gen Z is ready to buy: Boost your business by mastering co-buying