In 2025, NAR focused on policies, listening and responding to members’ concerns. Here’s how the organization and its leaders navigated an industry in turmoil.

Inman Connect

Invest in yourself, grow your business—real estate’s biggest moment is in San Diego!

Invest in yourself, grow your business—real estate’s biggest moment is in San Diego!

It was a year of reinvention for the nation’s largest trade organization.

When 2025 began, the National Association of Realtors had just lumbered through years of bad publicity, mistrust, legal setbacks and negative sentiment among its nearly 1.5 million members.

In response, NAR brought on a new CEO in mid-2024. And by the start of 2025, that CEO — Nykia Wright — knew what she had to do: change the organization or face extinction.

“Most legacy companies make their way to the extinction bin if they are not continuing to reinvent themselves,” Wright said at Blueprint Las Vegas in September. “My responsibility is to reinvent the organization.”

By January, Wright and her team were embarking on a year of change. And with 2025 now wrapping up, here are some of the trends, changes and evolutions that characterized NAR’s story this year.

Eliminating (some) risk

NAR in 2025 aimed to get rid of potential legal risks to the organization, in part by pushing decisions to the local level instead of playing national rule-maker and watchdog.

The group shook up its legal team in part to guide an effort at examining its existing risk and getting rid of what it could, Jon Waclawski, NAR’s general counsel, said on a recent podcast.

“What was done this calendar year were things that were intentional because they could be done in a relatively short period of time,” Waclawski said. “There are more complicated aspects to the risk analysis that need to be vetted and engaged with stakeholders across the industry for the next year and maybe even longer.”

The group voted in November to allow for more MLSs to provide access to non-Realtors, a move that more MLSs are openly discussing — or already taking on their own.

In general, NAR has focused on providing any change that would be viewed as providing more choice for consumers, a line repeatedly shared by Kevin Sears, who was the group’s president for nearly the past two years before handing the baton to President Kevin Brown last month.

At times that has meant staying out of the mix altogether: When it came to Zillow’s choice to integrate its platform with ChatGPT, NAR opted not to weigh in and said that it was up to each individual MLS to decide whether Zillow was in compliance with rules.

Changing (some) policies

While the organization did make some changes, it ended up being the policies NAR didn’t change that sparked the biggest debates in the industry.

Last year, pressure began mounting on NAR to repeal or reform its Clear Cooperation Policy, which required members to place listings on the public-facing MLS no later than a day after marketing begins.

Industry titans were openly lobbying the group in different directions, perhaps most notably with Compass calling for the outright repeal of the policy.

In March, NAR announced it would keep the Clear Cooperation Policy in place while also giving MLSs the ability to allow for some delayed marketing. The move was met with mixed feedback among key industry players.

Within weeks, Zillow announced that it would enact its own policy: Agents must post their listings on the MLS and Zillow or the listing would be permanently banned from appearing on the mega portal. That policy then ignited into one of the hottest flash points in the industry heading into 2026.

Also this year, NAR failed to pass an amendment to the Realtor Code of Ethics that would have broadened how Realtors disclose sources of compensation to their clients.

After failing to pass the amendment, a handful of brokerages and other organizations came out with their own updated rules around referral revenue disclosure, with some saying they wouldn’t wait for NAR in order to add a new level of transparency for clients.

Earlier, NAR overturned its no-commingling rule at its mid-year conference in Washington, D.C. The policy was repealed in June, although Zillow had already quietly begun to commingle non-MLS listings with MLS listings on its huge platform for months before the change was made official.

Brand repair

Starting off the year, NAR had its work cut out for itself.

Surveys found that agents were unhappy with the organization, with sentiment among members eroding both before and after the Sitzer | Burnett verdict and settlement.

To kick off the year, NAR brought on Sherry Chris to serve as a special adviser. Specifically, Chris began playing the role of peacemaker between NAR and the nation’s biggest brokerages, which were left out of the settlement agreement a year earlier.

Chris brokered meetings between NAR and the big brokerages at a time when NAR was hyper-focused on listening to what its members wanted from the organization.

And there was apparent reason to bring on the industry bigwig: Major players such as Howard Hanna have been vocal about their view of NAR, with CEO Hoby Hanna claiming that the trade organization “sold the industry down the river.”

As Chris brokered meetings, Wright also vowed to bring new transparency to the organization. And she kicked off a widespread outreach and listening campaign to hear what members wanted from NAR.

After over a year of work, NAR announced that it had entered a new era of change, vowing to modernize the way it talked to and empowered its members. The group will begin implementing a three-year strategic plan starting in the new year.

Key court wins

NAR opened up the year with a loss when the Supreme Court declined to take up its appeal of the DOJ’s efforts to reopen a previously closed investigation into the organization.

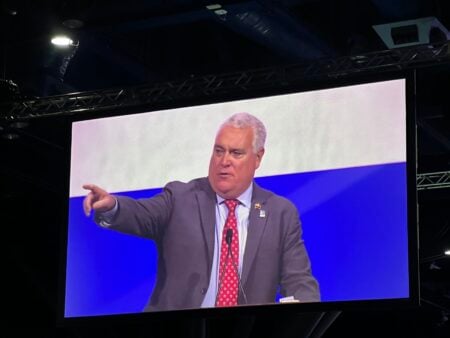

Kevin Sears, NAR president, runs the meeting of the Board of Directors at NAR NXT 2025 in Houston.

In May, Inman reported that NAR had replaced its outside law firm for antitrust litigation with a new one that charges up to $3,000 an hour.

And eventually, the organization scored a series of legal wins in 2025. Those wins included a court siding with NAR and co-defendants in a lawsuit filed by the Utah-based discount broker Homie, as well as multiple wins in lawsuits over the so-called three-way agreement that requires agents to be members of local, state and national Realtor associations.

Remaking NAR staff

Nykia Wright began serving as interim CEO in November 2023, but 2025 was the year she began reshaping the staff that would support her and serve members.

In January, in addition to Chris, NAR brought on Jarrod Grasso, who became the “first-ever” senior vice president of industry relations. Grasso’s role included strengthening connections with NAR local and state chapters and multiple listing services.

In February, NAR named a new general counsel.

In March, it appointed a new chief financial officer. That job involves combing through NAR’s finances, making sure it’s trimming bloat and can continue making upcoming payments as part of the $418 million settlement.

Later in March, the group eliminated 61 positions as part of its overhaul. In May, the communications team was reshaped.

Amid all the change, industry insiders who had pushed NAR for change said Wright was listening and responding in kind.

“She is very smart, tactical, and she moves quickly,” said James Dwiggins, CEO of NextHome. “Her background is all about turning around companies. The real estate industry has been very critical of NAR the past 24 months and asking for change. That’s exactly what they are getting with Nykia at the helm.”

Holding onto numbers

With 2025 all but over, NAR is bracing for an exodus of members but hoping that its ranks stay as “sticky” as they have in recent years. The group budgeted for 1.2 million members in 2026. That would be a nearly 20 percent drop from the 1.49 million members it has now.

Fewer members means less money from annual dues and assessments at a time when NAR is still paying the antitrust settlement tab.

As of the end of September, after a period of belt-tightening, the group had $267.2 million in marketable securities and a cash balance of $62.6 million.

Among other things, cost-cutting meant shedding things like the printed version of Realtor magazine. NAR also pulled the plug on its annual Innovation, Opportunity & Investment (iOi) Summit, which started in 2018.

The group’s strong cash position comes in part because it voted in June to take most of the $45 annual advertising assessment that members pay and use it instead for operating expenses.

Email Taylor Anderson

Topics: NAR Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next $200K per year by Year 3: From part-time agent to powerhouse

$200K per year by Year 3: From part-time agent to powerhouse

Why your real estate email campaigns aren’t converting (yet)

Why your real estate email campaigns aren’t converting (yet)

Rate cuts, podcasts, buyer’s agents: Inman's Top 5

Rate cuts, podcasts, buyer’s agents: Inman's Top 5

FHA will back loans up to $1.249M in high-cost markets next year

More in MLS & Associations

FHA will back loans up to $1.249M in high-cost markets next year

More in MLS & Associations

Watchdog: Agents earn too little. Consumers pay too much

Watchdog: Agents earn too little. Consumers pay too much

Zillow stalemate with Chicago's MLS looks like it's coming to a head

Zillow stalemate with Chicago's MLS looks like it's coming to a head

Many agents contemplate leaving NAR if their MLS lifts policy: Intel

Many agents contemplate leaving NAR if their MLS lifts policy: Intel

The transparency crisis no one wants to talk about

The transparency crisis no one wants to talk about

Read next

Read Next

After failed NAR vote, brokerages beef up referral disclosures

After failed NAR vote, brokerages beef up referral disclosures

6 housing market predictions for 2026, according to an economist

6 housing market predictions for 2026, according to an economist

Why your real estate email campaigns aren’t converting (yet)

Why your real estate email campaigns aren’t converting (yet)

Rate cuts, podcasts, buyer’s agents: Inman's Top 5

Rate cuts, podcasts, buyer’s agents: Inman's Top 5