Property market expert, Kate Faulkner, takes a more detailed look at house price activity in Northern Ireland, Scotland and Wales.

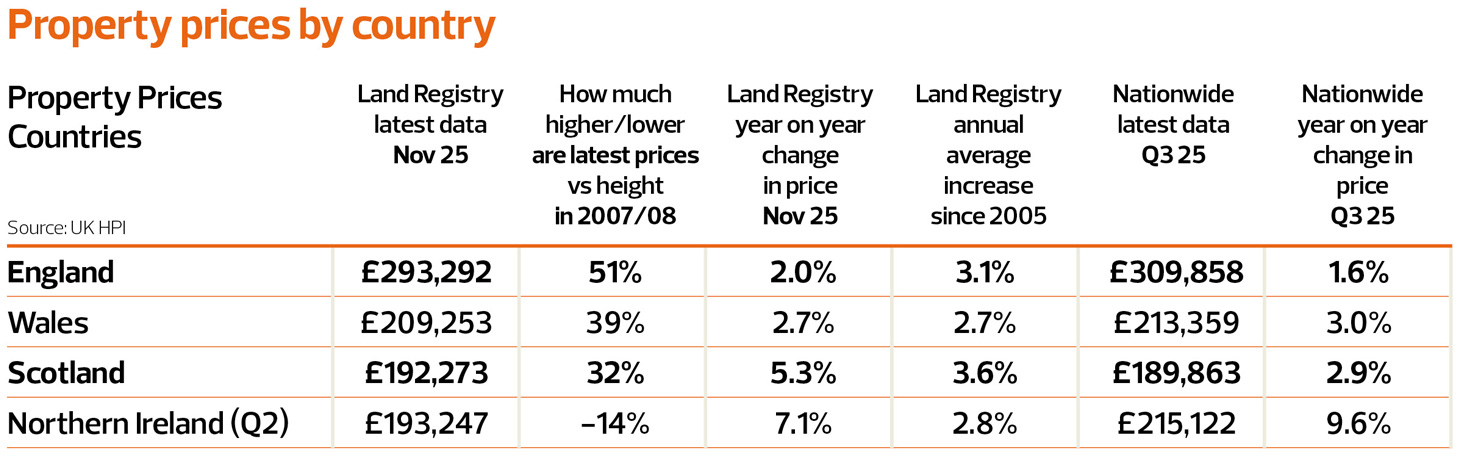

22nd Dec 20250 128 3 minutes read Kate Faulkner OBE Overall, each ‘country’ market is performing well, although England and Wales are seeing year on year house price rises either on a par or lower than their historic average and certainly lower than the 3.4% inflationary rise.

Overall, each ‘country’ market is performing well, although England and Wales are seeing year on year house price rises either on a par or lower than their historic average and certainly lower than the 3.4% inflationary rise.

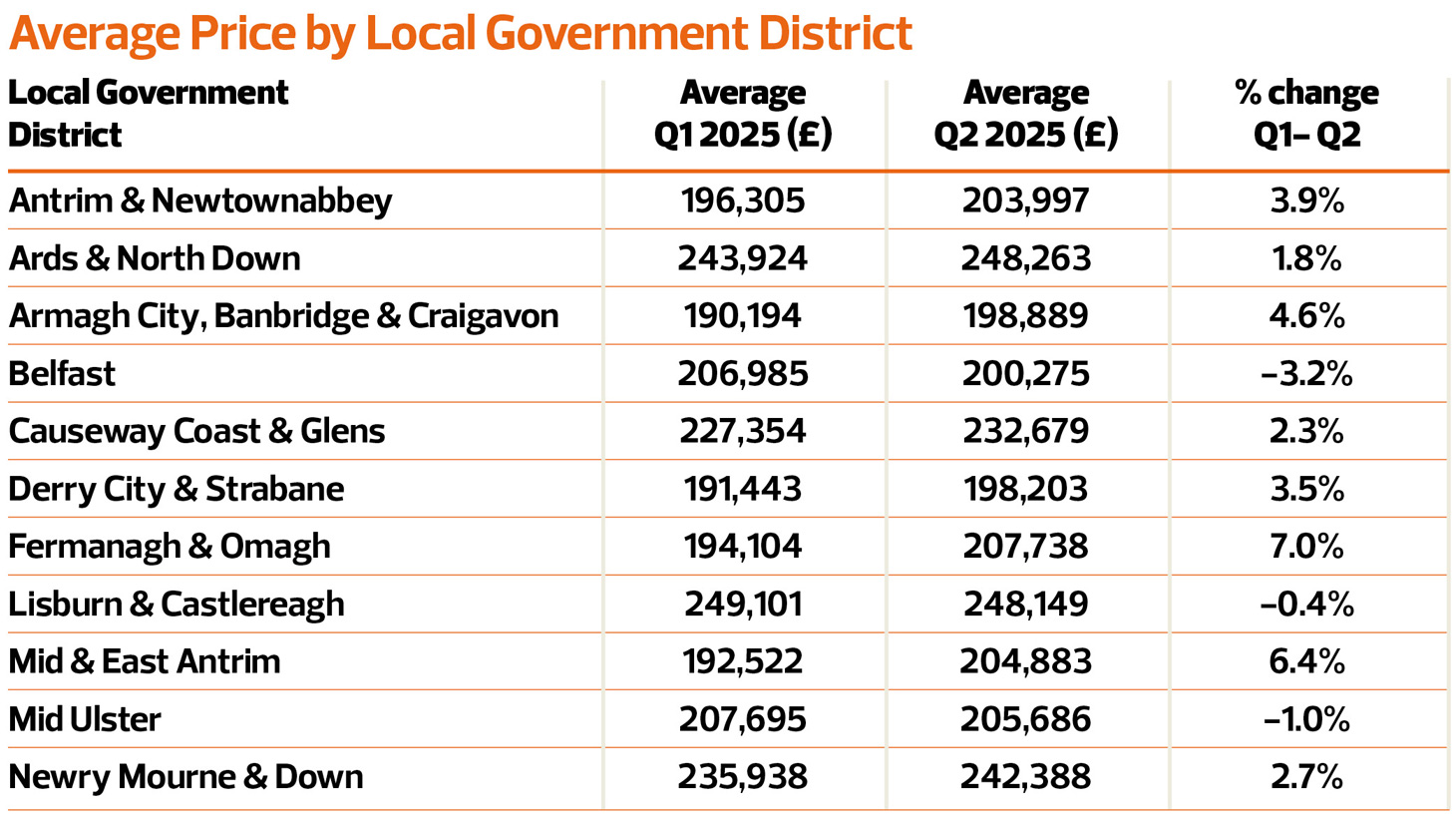

However, each country has its high and low performing areas, so this month, I’ve added in some more in depth reports on what’s happening in each Northern Ireland, Scotland and Wales at a more local level.

Halifax

“Northern Ireland continues to post the strongest rate of annual property price inflation, with average values up +8.0% over the past year (up from +6.4% last month). The typical home now costs £219,646. Scotland recorded annual price growth of +4.4% in October, up to an average of £216,051. In Wales, property values rose +2.0% year-on-year to £229,558.”

Zoopla

“In Scotland, Wales and the northern regions of England, prices are still rising at just over 2%, showing a steady pace similar to last year. Meanwhile, across southern England, price growth has largely stalled as affordability pressures and softer demand keep a lid on increases.”

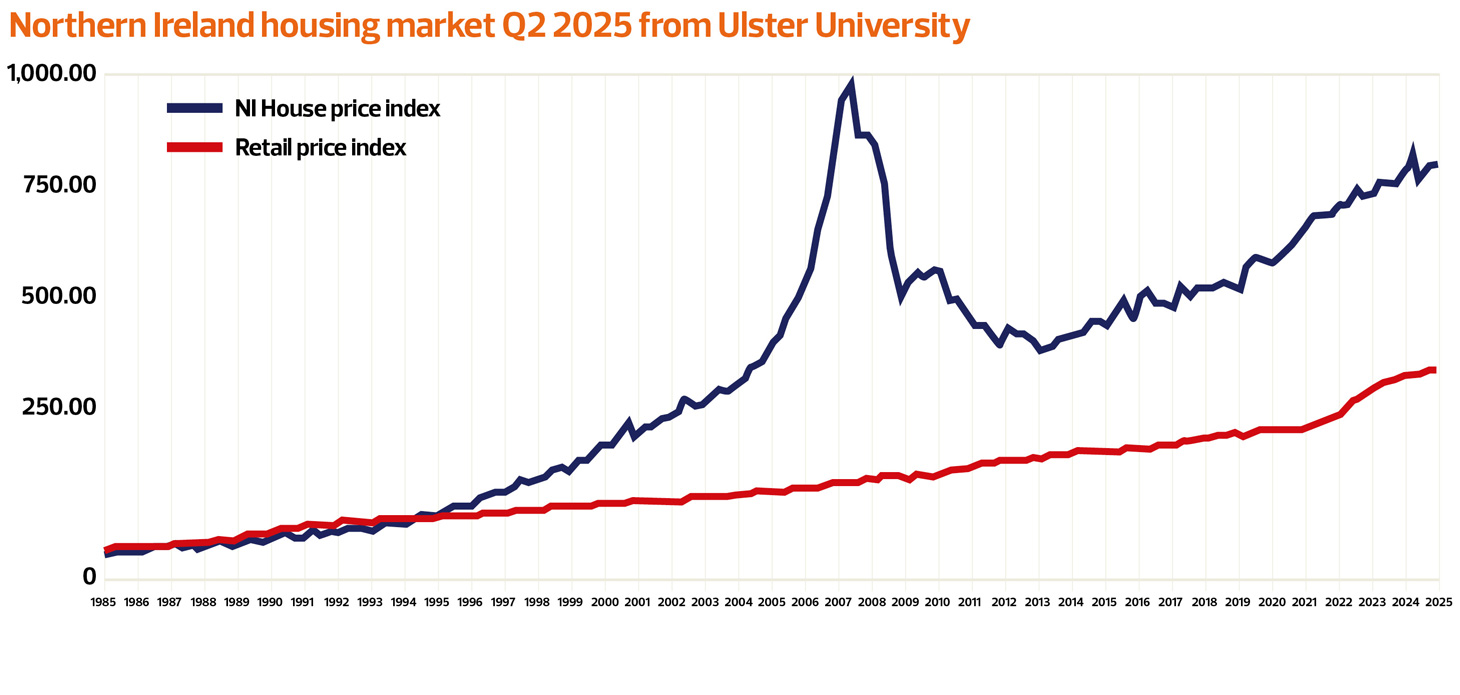

Northern Ireland housing market Q2 2025 Long term it’s easy to see from this chart from Ulster University how high property prices peaked prior to the credit crunch and that although prices have risen well since 2019 and are still increasing year on year, they are still taking an awful long time to recover to the heights achieved nearly 20 years ago!

Long term it’s easy to see from this chart from Ulster University how high property prices peaked prior to the credit crunch and that although prices have risen well since 2019 and are still increasing year on year, they are still taking an awful long time to recover to the heights achieved nearly 20 years ago!

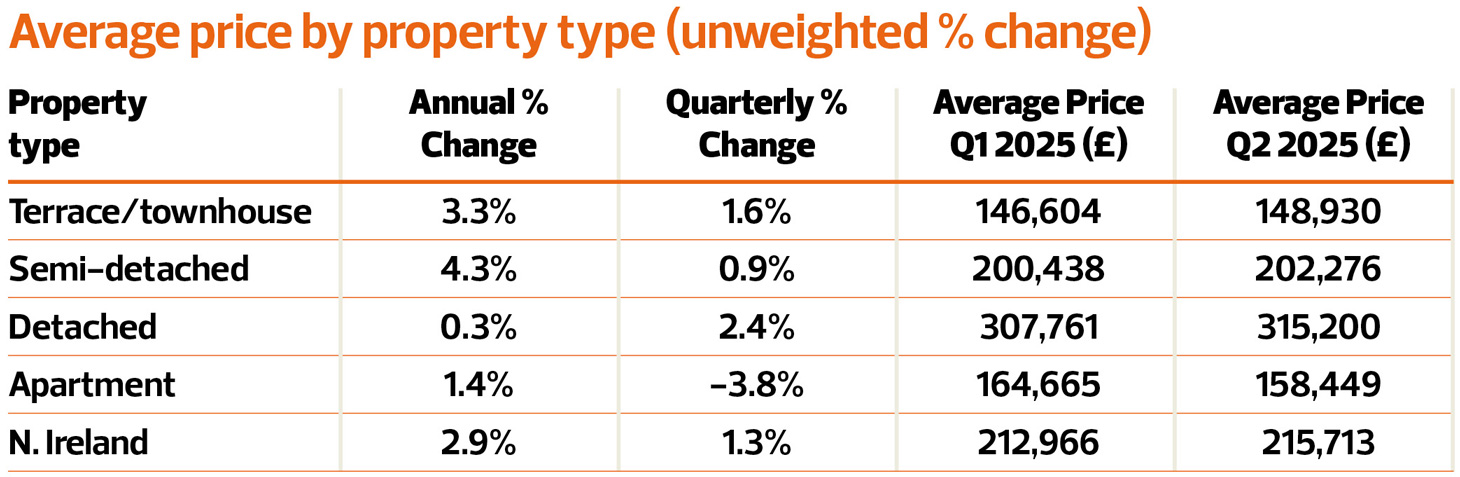

“Evidence indicates that market listings and bidding activity have increased generally across the housing market, with the average price of properties transacting during Q2 2025 standing at £215,713. Quarterly change statistics showed the index to be up 1.4% relative to Q1 2025, with annual price statistics showing a weighted increase of 2.7% in comparison to Q2 2024.

“Agents remain largely positive about market sentiment, with 45% reporting increased buyer and seller confidence. One respondent stated that ‘Q2 was certainly a lot stronger than Q1, for buyer listings and completions.’ Several agents pointed to competition among mortgage lenders and the potential for interest rate base cuts as key tailwinds for the market, anticipating that these factors could sustain the continued market optimism over the next two quarters.

“Heading into the second half of 2025, agents appear cautiously bullish. While macroeconomic conditions continue to cast a long shadow on potential market optimism, on-the-ground activity and sentiment are seemingly continuing to improve. With competition between mortgage providers heating up, the foundation for a stable market appears to be taking shape.”

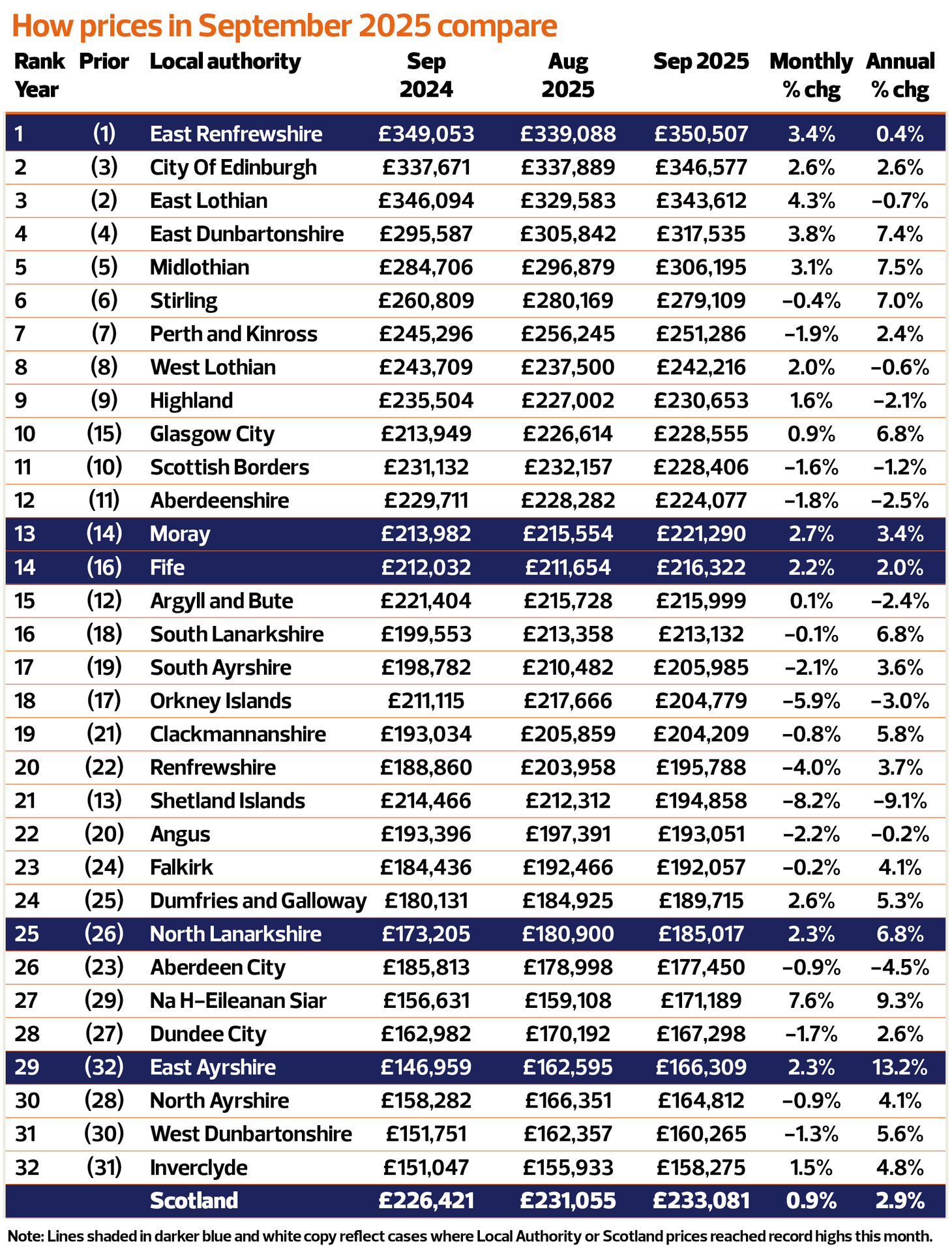

Commentary from Walker Fraser Steele says:

“Scottish buyers appear better able to shrug off the economic and financial headwinds than their counterparts south of the border.

“Year-on-year comparisons remain favourable, with 22 local authorities reporting stronger prices than a year ago. Two authorities – Glasgow and Renfrewshire – continue to match Scotland in reporting annual price rises every month since the start of 2024.

“Among the “risers” in August, 11 reported price increases of at least 5% over the year, whilst Shetland was the sole authority experiencing an annual price decline of this magnitude.”

Scott Jack, Regional Development Director at Walker Fraser Steele, comments: “Scotland’s housing market continued to outperform expectations in September, with average prices reaching a record £233,100. This represents a 0.9% monthly rise and follows strong gains over the past two months, reinforcing the sense of momentum. Transactions are also improving, with estimated sales in August at their highest level for three years, suggesting demand remains resilient despite wider economic uncertainty.

“Price growth is evident nationwide. Five local authorities, including East Renfrewshire and Fife, set new highs in September, bringing the total to 19 authorities that have hit records at some point in 2025. While monthly movements vary, the overall picture contrasts sharply with the subdued performance seen in England and Wales, according to Acadata figures.”

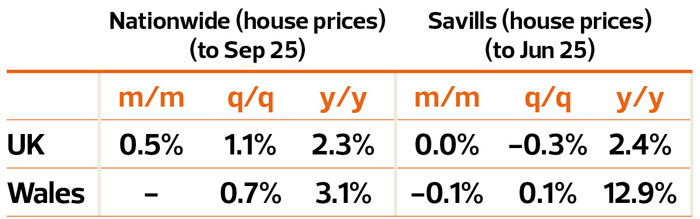

Data from Savills says:

“Market activity has been quite strong so far in 2025…. House prices in Wales rose by 3.1% in the year to September, according to Nationwide, and have now fully recovered from their dip in 2022 and 2023…..with transactions 12% higher than last year and just -5% down on the 2017-19 average across the first eight months.

“However, with the pace of interest rate cuts expected to slow, continued transaction growth into 2026 is not guaranteed.”

One key difference between England and Wales is that unlike the English market, Wales kept the Help to Buy Scheme, although its use “remains well below peak and has begun to plateau… 9% of new homes were purchased under the scheme in the year to March, a level that has remained broadly consistent for the last few quarters.”

For next year, Savills “expect a quiet 2026, before stronger price growth from 2027 onwards.”

22nd Dec 20250 128 3 minutes read Kate Faulkner OBE Share Facebook X LinkedIn Share via Email