Home sales should break through the 5 million mark next year as more inventory gradually comes on the market and home prices decline, economists at the Mortgage Bankers Association predict.

Quick Read

- The Mortgage Bankers Association forecasts sluggish economic growth of 1.5 percent to 1.7 percent from 2026-2028, with a 35 percent chance of recession and unemployment rising to 4.7 percent in early 2026.

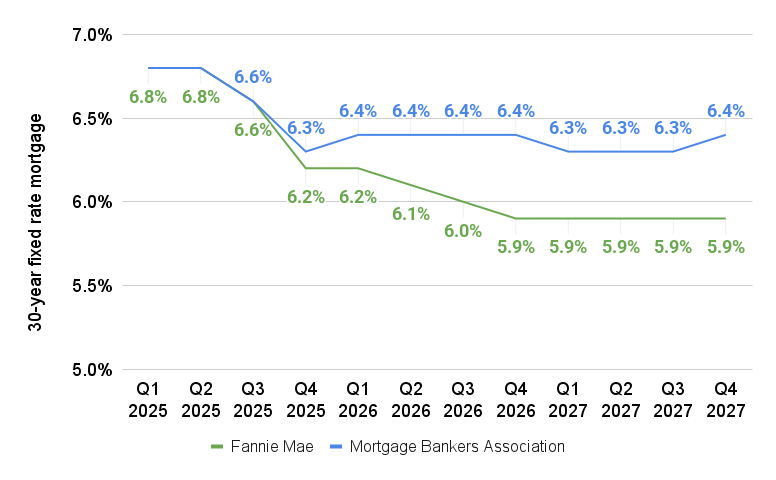

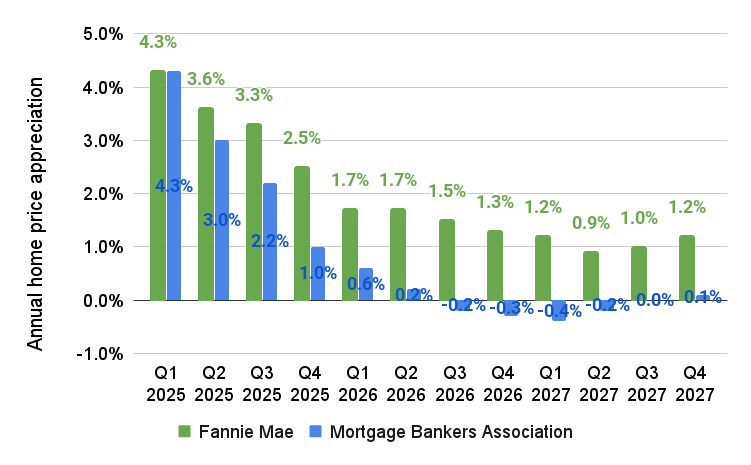

- Home sales are projected to surpass five million in 2026, driven by rising inventory and moderating home prices, with existing home sales up nearly 7 percent and new home sales increasing 6.5 percent.

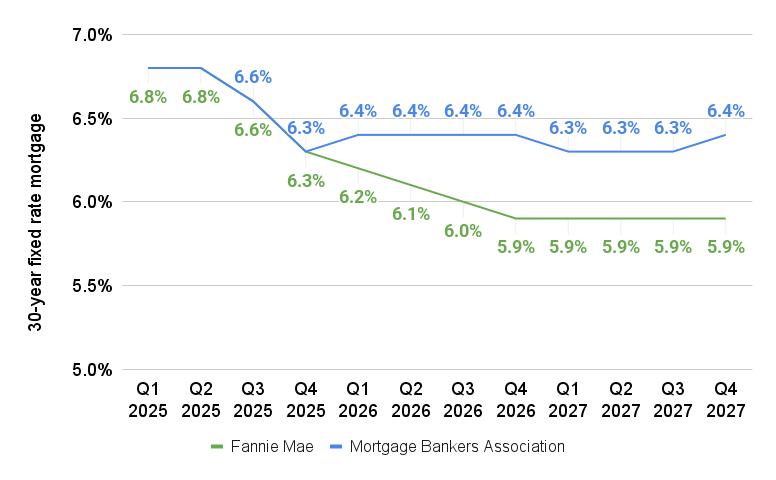

- MBA forecasts mortgage rates will stabilize between 6.2 percent and 6.5 percent through 2027, while Fannie Mae expects rates below 6 percent by the end of 2026, indicating some divergence in projections.

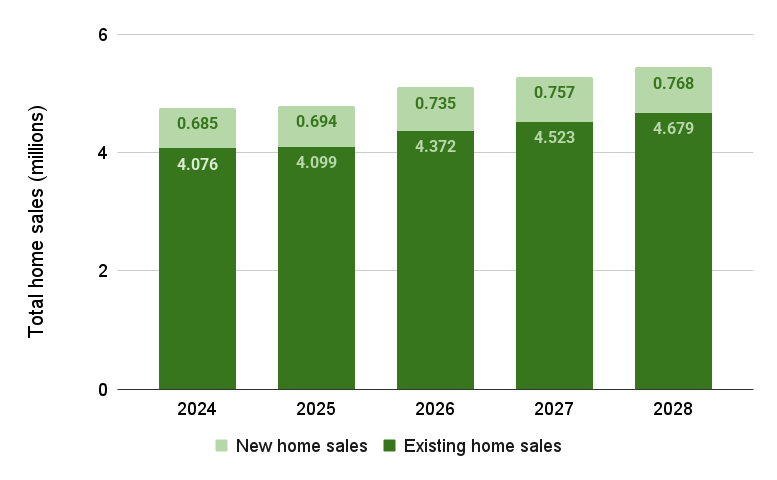

- National home prices may decline in the latter half of 2026 due to increased supply and weaker demand, with price growth expected to resume in late 2027, according to MBA economists.

Look for the economy to remain sluggish for the next three years but for home sales to inch up as mortgage rates stabilize in the mid-sixes, economists at the Mortgage Bankers Association say.

The MBA’s December economic and mortgage forecasts predict there’s a roughly 35 percent chance of a recession next year, with unemployment likely to rise to 4.7 percent in the first half of the year.

While signs point to “below trend” economic growth of 1.5 to 1.7 percent from 2026 through 2028, home sales should break through the five million mark next year as more inventory gradually comes on the market and home prices decline, MBA forecasters say.

TAKE THE INMAN INTEL SURVEY FOR DECEMBER

“Our forecast is for mortgage rates to stay within a narrow range over the next few years, between 6 [percent] and 6.5 percent,” MBA forecasters Mike Fratantoni, Joel Kan and Judie Ricks said in commentary accompanying their forecast. “This forecast becomes more likely as the Fed reaches the end of its cutting cycle next year.”

Mortgage rate forecasts diverge

Source: Fannie Mae and Mortgage Bankers Association December, 2025 forecasts.

Federal Reserve policymakers approved their third rate cut of the year on Dec. 10, but issued economic projections suggesting that they might cut rates just once next year. The latest payroll and employment data released Dec. 16 showed the unemployment rate ticking up to 4.6 percent in November, with 7.831 million Americans out of work.

In a forecast made public on Dec. 23, Fannie Mae economists predicted rates on 30-year fixed-rate conforming loans will fall below 6 percent by the end of next year.

MBA forecasters this month are sticking with the mortgage rate forecast they issued in November, which predicted rates will average 6.4 percent in 2026 and 6.3 percent for much of 2027.

“The government shutdown continues to impact the availability and timeliness of key economic data,” MBA forecasters said. “Our overall outlook remains quite like prior months, but certainly could be altered as additional data flow in.”

Home sales expected to top 5M in 2026

Source: Mortgage Bankers Association December, 2025 forecast.

The MBA estimates that home sales grew by less than 1 percent in 2025, to 4.793 million. But sales of existing homes are expected to surge by nearly 7 percent next year, to 4.372 million, with new home sales also rising by 6.5 percent, to 735,000.

“Housing inventory continues to grow in many markets around the country, and this increased supply has helped to increase purchase activity as home buyers have more options to choose from and home price growth continues to moderate, with outright home price declines in a growing number of markets,” MBA economists said.

The MBA forecasts that sales of existing and new homes will continue to grow at an annual rate of more than 3 percent in 2027 and 2028.

Fannie Mae’s more optimistic take on where mortgage rates are headed next results in a more bullish forecast for sales of existing homes, which are projected to grow by 7.5 percent next year and 7.9 percent in 2027.

Will home prices fall next year?

Source: Fannie Mae (October) and Mortgage Bankers Association (December), 2025 forecasts.

MBA economists see national home price appreciation turning negative in the second half of next year on rising inventory levels and weaker demand, and not posting positive growth until Q4 2027.

Fannie Mae’s home price forecast, last updated in October, predicts home price appreciation will cool to 1.3 percent by the end of next year but remain positive.

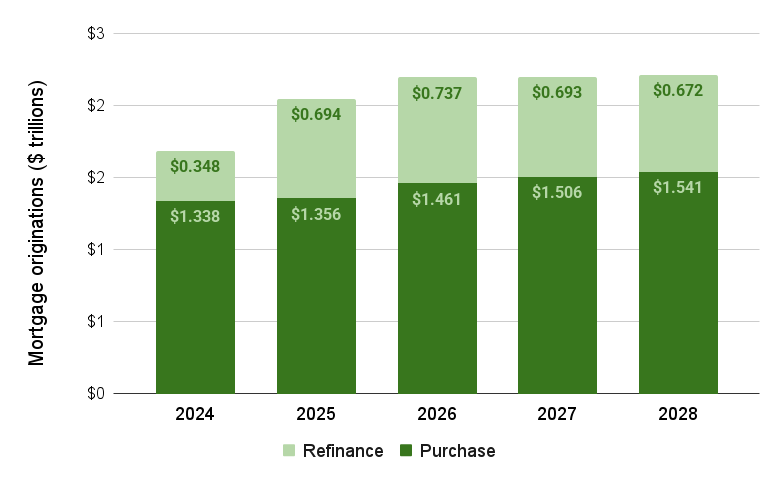

Refinancing surged by 22% this year

Source: Mortgage Bankers Association December, 2025 forecast.

The significant drop in mortgage rates in 2025 — from 7.05 percent in January to a 2025 low of 6.12 percent in October, according to lender data tracked by Optimal Blue — boosted 2025 mortgage refinancing volume by 22 percent, to an estimated $694 billion.

Rising home sales are expected to boost purchase mortgage originations by nearly 8 percent next year, to $1.461 trillion, with refi volume also growing by 7 percent, to $737 billion, as ups and downs in mortgage rates create “brief spells” of refinance opportunities.

While purchase loan volume is forecast to grow by 3 percent in 2027 and 2 percent in 2028, refinancing volume is expected to contract below 2025 levels as mortgage rates stabilize.

Editor’s note: This story was updated to include information from Fannie Mae’s latest housing forecast, which was made public on Dec. 23.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Topics: lenders Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Mortgage demand dips as Fed signals cautious approach to rates

Mortgage demand dips as Fed signals cautious approach to rates

How to convert renters into buyers in 2026

How to convert renters into buyers in 2026

More agents pondered an exit from real estate in 2025. Intel asks why.

More agents pondered an exit from real estate in 2025. Intel asks why.

Yet another report says the real estate market is sputtering

More in Mortgage

Yet another report says the real estate market is sputtering

More in Mortgage

Cotality and Ascend licensed to generate FICO scores for lenders

Cotality and Ascend licensed to generate FICO scores for lenders

Seasonal cooling sweeps market as buyers grapple with affordability

Seasonal cooling sweeps market as buyers grapple with affordability

Mortgage demand dips as Fed signals cautious approach to rates

Mortgage demand dips as Fed signals cautious approach to rates

UWM bets on mortgage servicing with $1.3B Two Harbors acquisition

UWM bets on mortgage servicing with $1.3B Two Harbors acquisition

Read next

Read Next

How boutique brokerages can thrive as big brands merge

How boutique brokerages can thrive as big brands merge

Buyer's agent commissions see rebound in wake of settlement

Buyer's agent commissions see rebound in wake of settlement

Mortgage demand dips as Fed signals cautious approach to rates

Mortgage demand dips as Fed signals cautious approach to rates

Yet another report says the real estate market is sputtering

Yet another report says the real estate market is sputtering