Quick Read

- President Trump directed Fannie Mae and Freddie Mac to invest nearly all their reserves, about $200 billion, into mortgage bonds, leading to a drop in 30-year fixed mortgage rates to 5.99 percent, the lowest since September 2022.

- Federal Housing Finance Director Bill Pulte confirmed compliance, noting mortgage rates depend on investor demand for mortgage-backed securities (MBS), which Fannie and Freddie typically guarantee and also hold as investments.

- Analysts project the bond purchases could lower rates by 10 to 25 basis points, but impacts may be limited compared to past Federal Reserve quantitative easing programs that involved significantly larger MBS purchases.

- While bond buying could support a public offering for Fannie and Freddie, experts warn that increased MBS holdings expose them to risks reminiscent of the 2008 financial crisis, especially if the housing market weakens.

Although $200 billion sounds like a lot of money, the impact and longevity of Fannie and Freddie’s bond purchases on mortgage rates won’t be as big as the Federal Reserve’s.

President Trump’s promise that Fannie Mae and Freddie Mac will buy $200 billion in mortgage bonds had mortgage rates dropping to the lowest level since 2023 on Friday, but how much additional leeway rates have to come down remains to be seen.

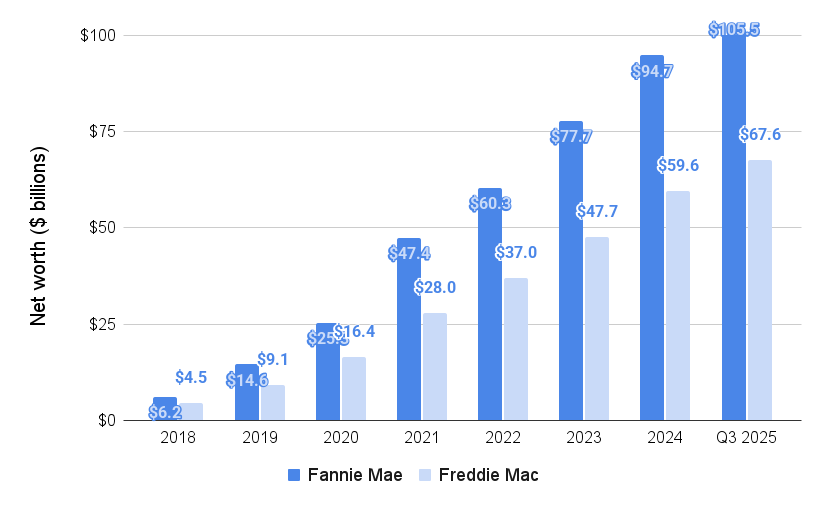

Asserting that Fannie and Freddie have amassed “an absolute fortune,” Trump announced on Truth Social on Thursday that he’s ordered the mortgage giants to put almost all of the reserves they’ve built up in recent years into mortgage bonds — a move that could expose the mortgage giants to losses if the housing market goes soft.

“We are on it, Mr. President,” Federal Housing Finance Director Bill Pulte, who also chairs Fannie and Freddie’s boards, replied on X.

The move is an acknowledgement that although the Federal Reserve cut short-term rates three times last year by a total of three-fourths of a percentage point, it doesn’t have direct control over mortgage rates, which are largely determined by investor demand for mortgage-backed securities (MBS) that fund most mortgages.

Homebuyer demand dropped for the fifth consecutive week last week to the lowest level since October, with mortgage rates range-bound since late October and no longer moving down in sync with Fed rate cuts.

Fannie and Freddie typically guarantee payments to MBS investors, but also buy and hold a small portion as investments on their own books. By stepping up MBS purchases, the companies can, in theory, push mortgage bond prices up and mortgage rates down.

The mortgage giants quietly stepped up their MBS purchases in April, growing their combined retained mortgage portfolios by $55 billion, to $233.6 billion as of October.

Thursday’s news of more and bigger MBS purchases was enough to push rates down, with 30-year fixed mortgage rates dropping 22 basis points Friday to 5.99 percent — the lowest since September 2022, according to data tracked by Mortagage News Daily.

A basis point is one hundredth of a percent, so rates dropped nearly one-fourth of a percentage point on Friday.

But even though $200 billion sounds like a lot of money, the impact and longevity of Fannie and Freddie’s mortgage bond purchases on mortgage rates could be limited.

“We estimate the move will bring mortgage rates down 10 to 15 [basis points],” Redfin economist Chen Zhao wrote Thursday. “That means rates may decline to 6 percent from 6.1 percent or 6.15 percent. We don’t expect this to massively lower rates or unlock tons of inventory.”

With “spreads” between MBS and Treasuries already tightening, BTIG analyst Eric Hagen thinks Fannie and Freddie’s bond purchases could push mortgage rates down by another one-fourth percentage point — if spreads return to all-time lows seen when the Federal Reserve embarked on a massive “quantitative easing” campaign during the pandemic.

Reaching that level “was the outcome of the Fed buying a net +$40 billion per month from mid-2020 through 2021,” Hagen said in a note to clients Friday. “It’s not unrealistic for the GSEs [Fannie and Freddie] to similarly target $200 billion in net purchases over a six month horizon, although the timeline may depend on how much refi activity gets created as a result of the drop in mortgage rates.”

Some analysts, including Fannie Mae’s economic forecasting team, were already expecting mortgage rates to come down this year. So any additional downward pressure on rates would come on top of that.

TD Cowen analyst Gennadiy Goldberg, who had expected rates on 30-year fixed-rate loans to drop to 5.25 percent this year, said in a note to clients that if Fannie and Freddie execute the bond purchases over a short period of time, they could push rates down by an additional one-fourth percentage point, to 5 percent.

Fannie and Freddie’s limited resources mean the moves they make in the mortgage bond market won’t match the intensity and duration of the Fed’s massive purchases of government debt and mortgages.

In the first 10 weeks of the pandemic alone, the Fed bought $491 billion in mortgage-backed securities (MBS) and $1.57 trillion in Treasurys.

Like “quantitative easing” undertaken in the aftermath of the 2007-2009 Great Recession and financial crisis, the purchases were meant to keep the economy from crashing by making borrowing cheap.

The tactic worked, for a while, pushing mortgage rates to historic lows but also helping push home prices to record highs and unleashing inflation far above the Fed’s 2 percent target.

Fed balance sheet

Although the Fed stopped buying mortgages in 2022 and has been trimming its MBS holdings ever since, it still holds more than $2 trillion in mortgages.

The Fed resumed its purchases of Treasurys in December, and has more than $4.2 trillion in government debt on its books.

Fannie, Freddie net worth hits $173B

Source: Fannie Mae and Freddie Mac investor disclosures.

Fannie and Freddie have been building their net worths for nearly a decade, putting them in position to be relisted on the New York Stock Exchange and for the government to sell a small portion of its stake in the companies later this year.

Pulte told Barrons that buying mortgage bonds won’t hurt the prospects of a public offering, since Fannie and Freddie will earn more interest on reserves that are invested in MBS instead of Treasurys.

But in the event of a severe housing downturn, mortgage bonds are a riskier bet than Treasurys. Fannie and Freddie’s purchases of subprime MBS helped land the companies in government conservatorship in 2008.

While buying mortgage bonds might bring rates down “by a little bit,” it exposes Fannie and Freddie “to the exact same risks that got them blown up” in 2008, Structured Finance Association CEO Michael Bright told Politico.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Topics: lenders Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Fannie Mae and Freddie Mac are quietly stockpiling mortgages

Fannie Mae and Freddie Mac are quietly stockpiling mortgages

Fannie and Freddie's low-income homebuyer goals dialed back

Fannie and Freddie's low-income homebuyer goals dialed back

Fannie, Freddie regulator vows to protect consumers from rising credit report fees

Fannie, Freddie regulator vows to protect consumers from rising credit report fees

Pulte pledges Fannie, Freddie's help in curbing home purchases by institutional investors

More in Mortgage

Pulte pledges Fannie, Freddie's help in curbing home purchases by institutional investors

More in Mortgage

Pulte pledges Fannie, Freddie's help in curbing home purchases by institutional investors

Pulte pledges Fannie, Freddie's help in curbing home purchases by institutional investors

With mortgage rates down, home payments hit lowest level in 2 years

With mortgage rates down, home payments hit lowest level in 2 years

Homebuyer demand sags as mortgage rates stay range bound

Homebuyer demand sags as mortgage rates stay range bound

Newrez bets on AI with strategic investment in startup HomeVision

Newrez bets on AI with strategic investment in startup HomeVision

Read next

Read Next

Fannie Mae and Freddie Mac are quietly stockpiling mortgages

Fannie Mae and Freddie Mac are quietly stockpiling mortgages

The $92M real estate lesson Jake Paul taught us from the boxing ring

The $92M real estate lesson Jake Paul taught us from the boxing ring

How this Florida team stays $1B ahead of the competition

How this Florida team stays $1B ahead of the competition

Pulte pledges Fannie, Freddie's help in curbing home purchases by institutional investors

Pulte pledges Fannie, Freddie's help in curbing home purchases by institutional investors