Less than four months after Compass and Anywhere — two of the biggest companies in real estate — announced a planned merger, the firms closed the $1.6 billion deal on Friday after receiving a majority of shareholder approval.

Inman Connect

Invest in yourself, grow your business—real estate’s biggest moment is in San Diego!

Invest in yourself, grow your business—real estate’s biggest moment is in San Diego!

Less than four months after Compass and Anywhere — two of the biggest companies in real estate — announced a planned merger, the companies closed the $1.6 billion deal on Friday.

On Wednesday, shareholders of both companies approved the deal during special meetings. Nearly all Compass shareholders (99 percent) were in favor of the deal, while 72 percent of Anywhere shareholders voted for it to go through.

Robert Reffkin

Compass CEO Robert Reffkin will lead the merging of the two companies under Compass International Holdings as its chairman and CEO.

“Our collective vision is to become the best in the world at empowering real estate professionals with everything they need to realize their entrepreneurial potential,” Reffkin said in a press statement released Friday. “What makes this moment unique is not a transaction that combines two companies — it’s that the industry’s most respected brands and professionals are coming together on a single, modern technology platform that will help them save time, grow their business, and better serve their clients.”

Some real estate professionals had wondered if regulators would raise their eyebrows at the two residential giants’ plans to join forces. Compass is the biggest residential real estate brokerage in the U.S. by sales volume, with over $231 billion in sales volume as of 2024, according to RealTrends.

Anywhere, in second place, is not far behind with $183.81 billion in sales volume in 2024. The combined companies’ agent count is also substantial — Compass has about 40,000 agents, and Anywhere has 51,000 at owned-brokerages, plus 250,000 at franchises.

But despite Democratic senators Elizabeth Warren and Ron Wyden urging the Department of Justice and Federal Trade Commission to investigate the deal, antitrust regulators failed to take action by Jan. 2 — the deadline for them to do so under the Hart-Scott-Rodino Antitrust Improvements Act — Compass disclosed in a recent SEC filing.

With the all-stock transaction, Compass is taking on about $2.6 billion in Anywhere’s debt.

Compass also said in a SEC filing on Wednesday that it plans to offer $750 million in convertible senior notes in a private offering and give purchasers the option to buy an additional $112.5 million in notes within a 13-day period.

The brokerage additionally disclosed in a SEC filing on Thursday that it had priced a $850 million offering of convertible senior notes due in 2031 with the option to raise another $150 million. The notes can be converted at an implied stock price of about $15.98 per share, Compass said in the filing.

Capital raised with the convertible notes are allocated for “general corporate purchases,” according to the filing, which will help Compass pay down Anywhere’s debt and other costs incurred as a result of the deal.

On Friday, Compass also published an open letter to the firm’s agents, affiliate partners and employees laying out the brokerage’s vision, commitments and plans for the future. That letter can be viewed in its entirety at Compass’s online newsroom.

As he as done often in the past, Reffkin cited in the open letter his mother, Ruth, as his inspiration to create a company “that would do better for real estate professionals.” On Thursday, Reffkin also shared a selfie with Ruth on Instagram captioned with, “Celebrating a special day over dinner with my earliest inspiration.”

Reffkin reiterated in the open letter his commitment to the individual brands that will now operate under the Compass International Holdings umbrella, a point over which much scrutiny has been drawn in the industry.

“Each of our brands will continue to operate independently, supported by extraordinarily talented employees, and strengthened by a shared platform that delivers tools and integrated services that simply aren’t possible in a standalone model,” Reffkin wrote.

Later in the letter, he expressly states that the @properties, Better Homes and Gardens Real Estate, Century 21, Christie’s International Real Estate, Coldwell Banker, Compass, Corcoran, ERA and Sotheby’s International Realty brands will be preserved for company-owned and affiliate partners.

As for the firm’s plan moving forward, Reffkin outlined three major points of action: building the No. 1 place that agents search and use to run their business; building a network of leading brokerage-owned consumer sites where buyer inquiries go to the listing agent (citing the “your listing, your lead” philosophy); and building an industry where sellers have the choice of when, where and how to market their homes.

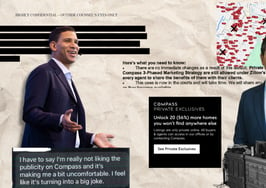

Even with Compass’s efforts to create a robust network of private exclusive listings within the firm, Reffkin also specified that “there will be no mandates or policies” requiring anyone to use Compass Private Exclusives.

He closed the letter by offering an open door to agents and employees.

“I look forward to learning from you as we build the future of real estate with purpose, integrity, and professionals at the center,” Reffkin wrote. “If you have ideas, feedback, or experiences to share, I want to hear from you. I’m honored to be on this journey alongside you, and I’m confident that we will be better together.”

Industry experts weigh in

Victor Lund

In terms of how the mega deal may impact the industry at large, WAV Group Founding and Managing Partner Victor Lund told Inman that it’s a “big nothingburger” from the agent and broker perspective.

“Today in Minneapolis, I was at a board meeting with the MLS and they have representation from all these brokerages in the room, and what they understand is that Compass expects these businesses to run as they run today,” Lund said. “That these companies are great companies, they’re well-run, they’re independent brands that are about a different offering to consumers, and Compass values that, and they want to maintain those eight brands.”

Lund added that the only slight impact from the two companies’ perspectives might be the need to shed a few offices if they both have a significant share in any given market. And if agents see a difference after the merger that they don’t like, “they’ll vote with their feet,” he added.

James Dwiggins

NextHome co-founder and CEO James Dwiggins had a different take, however, and expressed to Inman his concerns about “the largest M&A race the industry has ever seen” being set off in the wake of the transaction, ultimately providing consumers with fewer options and less power.

“In the next 36 months, three or four major companies will emerge controlling 60-70 percent of all U.S. real estate transactions — similar to the airlines,” Dwiggins told Inman in a text. “Private listings will go mainstream, taking the industry back 40 years and away from the system we spent so much time perfecting for consumers. The sad part is, homebuyers and sellers will be hurt in the process, and I worry about the reputation and legal scrutiny our industry will receive.”

Stefan Swanepoel, executive chairman of T3 Sixty, who has authored more than 55 books and reports on residential real estate, pointed out that this merger was the largest yet in a consolidation cycle the real estate consultancy first identified in the 2019 Swanepoel Trends Report.

Stefan Swanepoel

“That trend continues to concentrate market share into fewer, larger companies,” Swanepoel told Inman in an email. “Currently the consolidation is primarily at the national infrastructure level, not at the local brand level. At the local level, cloud-based platforms and remote operating models are now exerting the greatest consolidation pressure.”

Contrary to Dwiggins, Swanepoel suggested that major industry consolidation might be more of a gradual process over the course of several years.

“The residential real estate brokerage industry will still for many years to come continue to support tens of thousands of brokerages nationwide, but an increasing share of homebuying and selling transactions will flow under the umbrella of a relatively small group of very large real estate enterprises,” Swanepoel added.

Editor’s note: This story was updated after publishing with additional details about Robert Reffkin’s open letter.

Email Lillian Dickerson

Topics: Anywhere | Compass | Robert Reffkin | Ryan Schneider Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next Will Anywhere merger launch M&A arms race? It's not yet clear: Intel

Will Anywhere merger launch M&A arms race? It's not yet clear: Intel

Dems raise antitrust concerns over Compass-Anywhere merger

Dems raise antitrust concerns over Compass-Anywhere merger

A year in real estate marked by power grabs and a wave of change

A year in real estate marked by power grabs and a wave of change

Compass set to close Anywhere merger Friday after shareholders approve deal

More in Brokerage

Compass set to close Anywhere merger Friday after shareholders approve deal

More in Brokerage

How Compass, Zillow planned to win the private listing battle: Top 5

How Compass, Zillow planned to win the private listing battle: Top 5

Docs offer inside peek at Compass’ war against ‘organized real estate’

Docs offer inside peek at Compass’ war against ‘organized real estate’

‘What’s the worst-case scenario for the industry?’ 2 leaders answer ‘ask me anything’ questions

‘What’s the worst-case scenario for the industry?’ 2 leaders answer ‘ask me anything’ questions

How to create launch events that earn media attention, social buzz and buyer urgency

How to create launch events that earn media attention, social buzz and buyer urgency

Read next

Read Next

Want AI to recommend you in online search? Do these 7 things

Want AI to recommend you in online search? Do these 7 things

Will Anywhere merger launch M&A arms race? It's not yet clear: Intel

Will Anywhere merger launch M&A arms race? It's not yet clear: Intel

'No listings, no eyeballs, no sales': Zillow docs outline plans to win the private listing battle

'No listings, no eyeballs, no sales': Zillow docs outline plans to win the private listing battle

Compass set to close Anywhere merger Friday after shareholders approve deal

Compass set to close Anywhere merger Friday after shareholders approve deal