Quick Read

- FHFA Director Bill Pulte says Fannie Mae and Freddie Mac stand ready to support President Trump’s plan to restrict institutional investors from buying single-family homes, pending presidential directives.

- Pulte blames homebuilders for enabling investors to acquire homes at better deals, urging builders to focus on homes for individual buyers, while the NAHB warns against policies cutting capital for new construction.

- Studies show institutional investors hold a small share of the single-family rental market nationally but have significant presence in certain metros; legal experts note potential challenges to restrictive laws.

- Despite bipartisan affordable housing initiatives like the ROAD to Housing Act, legislative gridlock continues amid partisan debate over solutions to housing affordability and investor influence in the market.

Trump’s promise to “ban” large institutional investors from buying more single-family homes renews the debate over whether such a move would be legal — or make much of a dent on affordability.

The head of Fannie Mae and Freddie Mac’s federal regulator says he’s ready to enlist the mortgage giants in President Trump’s plan to stop institutional investors from buying up more single-family homes, but that it remains for the president to announce the specifics.

“We have a lot of tools that we could utilize,” Federal Housing Finance Agency Director Bill Pulte said Thursday in an appearance on CNBC. “It will be up to the President to decide what if any [tools] he wants to utilize with Fannie and Freddie, but we stand ready to make sure that this happens.”

As he and the president did last fall, Pulte pointed a finger of blame at homebuilders, saying institutional investors are “buying a lot of homes” from them and “are able to get better deals” — a swipe at the growing “build-to-rent” market segment.

“Homebuilders need to be focused on providing homes to people, not to corporations,” Pulte said. The National Association of Home Builders said in a statement that any new policies should “not cut off capital for new construction, including homes built for rent, which provide a critical source of new housing supply.”

“We appreciate President Trump’s efforts to create more opportunities for home ownership and look forward to working with the Administration on a broad range of policy ideas to do so,” NAHB Chairman Buddy Hughes said in a statement to Inman.

Pulte — who in addition to overseeing regulation of Fannie and Freddie, also chairs both companies’ boards — had previously turned up the heat on homebuilders in October, after Trump claimed they were “sitting on 2 million empty lots” and that he’d asked “Fannie Mae and Freddie Mac to get big homebuilders going.”

Fannie and Freddie don’t ordinarily provide funding to homebuilders directly, but purchase and guarantee mortgages taken out by many buyers of new homes. That’s led many analysts to question how much sway Pulte, FHFA, Fannie and Freddie actually have over homebuilders.

Pulte told an industry publication last fall that the FHFA had begun reviewing builder pricing, liquidity flows, and mortgage fraud risk data tied to loans Fannie and Freddie purchase, and that the review would shape how Fannie and Freddie engage with individual builders.

Although FHFA has yet to make a policy announcement, “action is going to be taken” to incentivize homebuilders, Pulte promised Thursday.

“Fannie and Freddie give billions of dollars worth of liquidity to the builders,” Pulte told CNBC. “We can change pricing, you know, we have a carrot and we can have a stick approach as well.”

Revisiting the single-family rental debate

Trump announced Wednesday on Truth Social that he planned “to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it.”

That has renewed the debate over whether such a “ban” would be legal, or whether other measures that might discourage institutional investor ownership of single-family homes — like an excise tax proposed by Democrats in 2023 — would make much of a dent in housing affordability.

California Gov. Gavin Newsom, a Democrat and vocal Trump opponent, was set to announce his own plans Thursday to work with state lawmakers on measures that could discourage investor ownership of single-family homes.

“Many state and federal legislators view the growing presence of institutional investors in the single-family rental market as a concerning development,” Brittany Kjerstad McKnight, an assistant professor of Business Law at South Dakota State University’s Ness School of Management and Economics, wrote in a 2024 case study of a bill that was introduced — but never passed — by Minnesota lawmakers.

“State laws that seek to impose restrictions on investor participation in the SFR market will likely face legal challenges, especially if formulated with retroactive application,” McKnight concluded.

Such laws could give rise to lawsuits based on constitutional issues including the Due Process Clause, the Equal Protection Clause, and potential breaches of the Takings Clause. Although carefully drafted state laws might pass muster on those issues, they could potentially run afoul of Commerce Clause principles that reserve for Congress the power to regulate interstate commerce.

“Many of the constitutional questions I discussed at the state level would likely be implicated by a federal restriction as well, depending on the law’s scope and design,” McKnight told Inman via email.

There’s also the question of how big an impact institutional ownership of single-family homes has had on affordability.

According to a roundup of recent studies and news reports by the Federal Reserve Bank of St. Louis, during the first half of 2025 a record high 30 percent of single-family home purchases were made by investors.

But most of the pickup in home sales to investors was attributed to small “mom-and-pop” investors.

“While large-scale, ‘institutional’ investors exert considerable influence in the 20 largest U.S. metropolitan areas, where they primarily operate, they form a small fraction of the national SFR market,” St. Louis Fed researchers concluded. “In 2025, their share of single-family home purchases was only one-fifth that of mom-and-pop investors.”

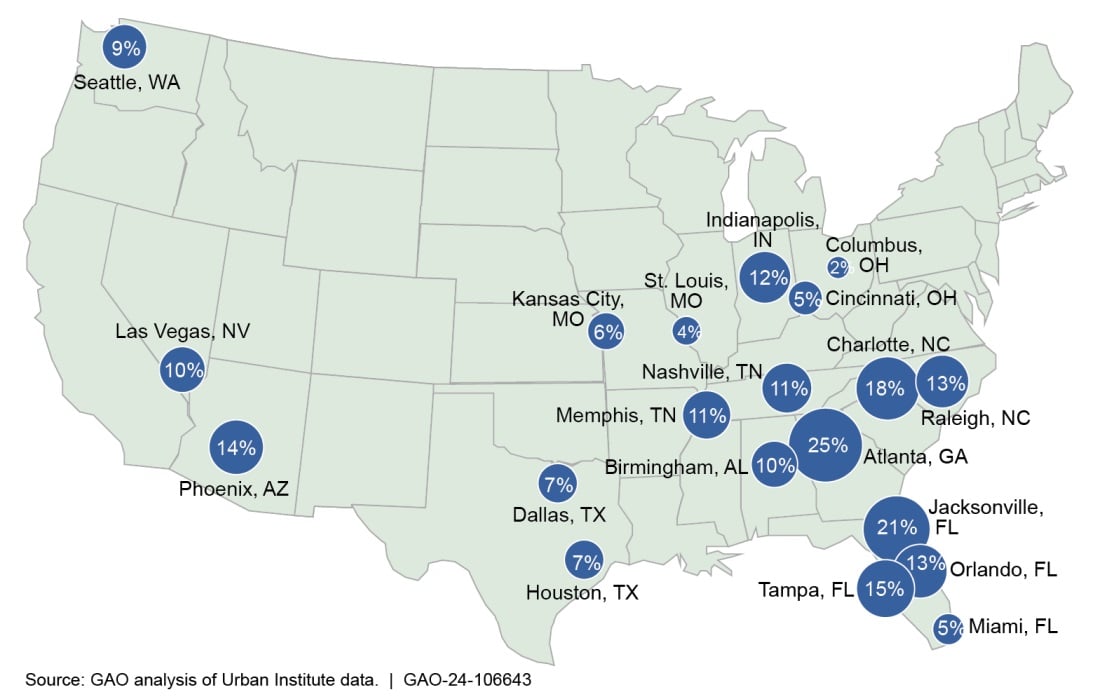

A 2024 analysis of Urban Institute data by the U.S. Government Accountability Office concluded that as of 2022, 32 “institutional investors” (defined as owning 1,000 properties or more) owned 450,000 single-family homes — or about 3 percent of the single-family rental (SFR) market.

That means institutional investors command an even smaller percentage of the total stock of single-family housing — both owner-occupied and rental housing.

Institutional investor SFR market share

But the GAO’s analysis showed institutional investors have a significant share of the single-family rental market in some metros, including Atlanta (25 percent), Jacksonville, Florida (21 percent), Charlotte, North Carolina (18 percent) and Tampa, Florida (15 percent).

Another interesting finding of the GAO report was that many single-family homes ended up in the rental market after the Great Recession and financial crisis of 2007-2009, when 3.8 million households lost their homes to foreclosure.

Under the Obama administration, the FHFA rankled Realtors by launching an REO-to-Rental pilot in 2012 that allowed bulk sales of foreclosed properties owned by Fannie Mae to pre-qualified investors.

During the first Trump administration, the FHFA allowed Fannie Mae to back a 10-year, $1 billion loan to Invitation Homes to purchase and manage single-family rental homes. Freddie Mac also had a pilot program providing liquidity to mid-sized (50–2,000 properties) investors in single-family rental properties.

The FHFA ordered Fannie and Freddie to scuttle both initiatives in 2018, following an assessment “that large institutional investors in single-family rental housing did not require additional liquidity,” the GAO noted.

But the Sunbelt cities “that initially experienced an influx of institutional investment following the financial crisis continue to have the largest amount of institutional investment,” the GAO report concluded.

Congress still gridlocked

Pulte on Thursday repeated the Trump administration’s claims that Democrats — and specifically Joe Biden — are to blame for rising home prices and mortgage rates that have helped fuel today’s housing affordability crisis.

Democrats “talked about this for a long time,” Pulte said. “They said, ‘Oh, we’d like to do it.’ President Trump is now taking action.”

But Trump’s Truth Social post coincided with Democrats’ own push to make housing affordability an issue in the 2026 midterm elections.

While the Trump administration has promised to make housing more affordable, it’s done little more than float dubious ideas like 50-year mortgages, Democrats allege.

“After the financial crash, Wall Street snapped up foreclosed homes and now uses algorithms to fix rents and pile on junk fees,” American Economic Liberties Project Executive Director Nidhi Hegde said in a press release issued by Senate Democrats Wednesday. “Today’s financialized homebuilding industry caters to Wall Street investors, restricting supply and driving up prices. And Donald Trump’s schemes like 50-year mortgages and letting firms like RealPage off the hook only exacerbate the crisis.”

Last year Republican Sen. Tim Scott, chair of the Senate Banking Committee, boasted of his work with ranking Democrat Sen. Elizabeth Warren to advance a comprehensive affordable housing bill, the Renewing Opportunity in the American Dream (ROAD) to Housing Act of 2025.

Much of the ROAD to Housing Act — which the Bipartisan Policy Center characterized as “the most impactful and comprehensive piece of housing legislation since the Great Recession” — was shoehorned into a defense spending bill, only to be stripped out by the House in December.

Bipartisan measures like the ROAD to Housing Act “are essential for strengthening the housing safety net and reducing instability for renters with the lowest incomes,” National Low Income Housing Coalition CEO Renee Willis said in a statement.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next SCOOP: Fannie and Freddie are cutting back on the information they publish

SCOOP: Fannie and Freddie are cutting back on the information they publish

GAO to look into claims Pulte has weaponized Fannie and Freddie

GAO to look into claims Pulte has weaponized Fannie and Freddie

Fannie and Freddie's low-income homebuyer goals dialed back

Fannie and Freddie's low-income homebuyer goals dialed back

Fannie, Freddie regulator vows to protect consumers from rising credit report fees

More in Mortgage

Fannie, Freddie regulator vows to protect consumers from rising credit report fees

More in Mortgage

With mortgage rates down, home payments hit lowest level in 2 years

With mortgage rates down, home payments hit lowest level in 2 years

Homebuyer demand sags as mortgage rates stay range bound

Homebuyer demand sags as mortgage rates stay range bound

Newrez bets on AI with strategic investment in startup HomeVision

Newrez bets on AI with strategic investment in startup HomeVision

Fannie, Freddie regulator vows to protect consumers from rising credit report fees

Fannie, Freddie regulator vows to protect consumers from rising credit report fees

Read next

Read Next

6 books that will rewire you in 2026. Add them to your reading list

6 books that will rewire you in 2026. Add them to your reading list

A year in real estate marked by power grabs and a wave of change

A year in real estate marked by power grabs and a wave of change

Fannie and Freddie's low-income homebuyer goals dialed back

Fannie and Freddie's low-income homebuyer goals dialed back

Fannie, Freddie regulator vows to protect consumers from rising credit report fees

Fannie, Freddie regulator vows to protect consumers from rising credit report fees